MiCA Compliance Guide: Navigating the EU's Crypto-Asset Regulatory Framework

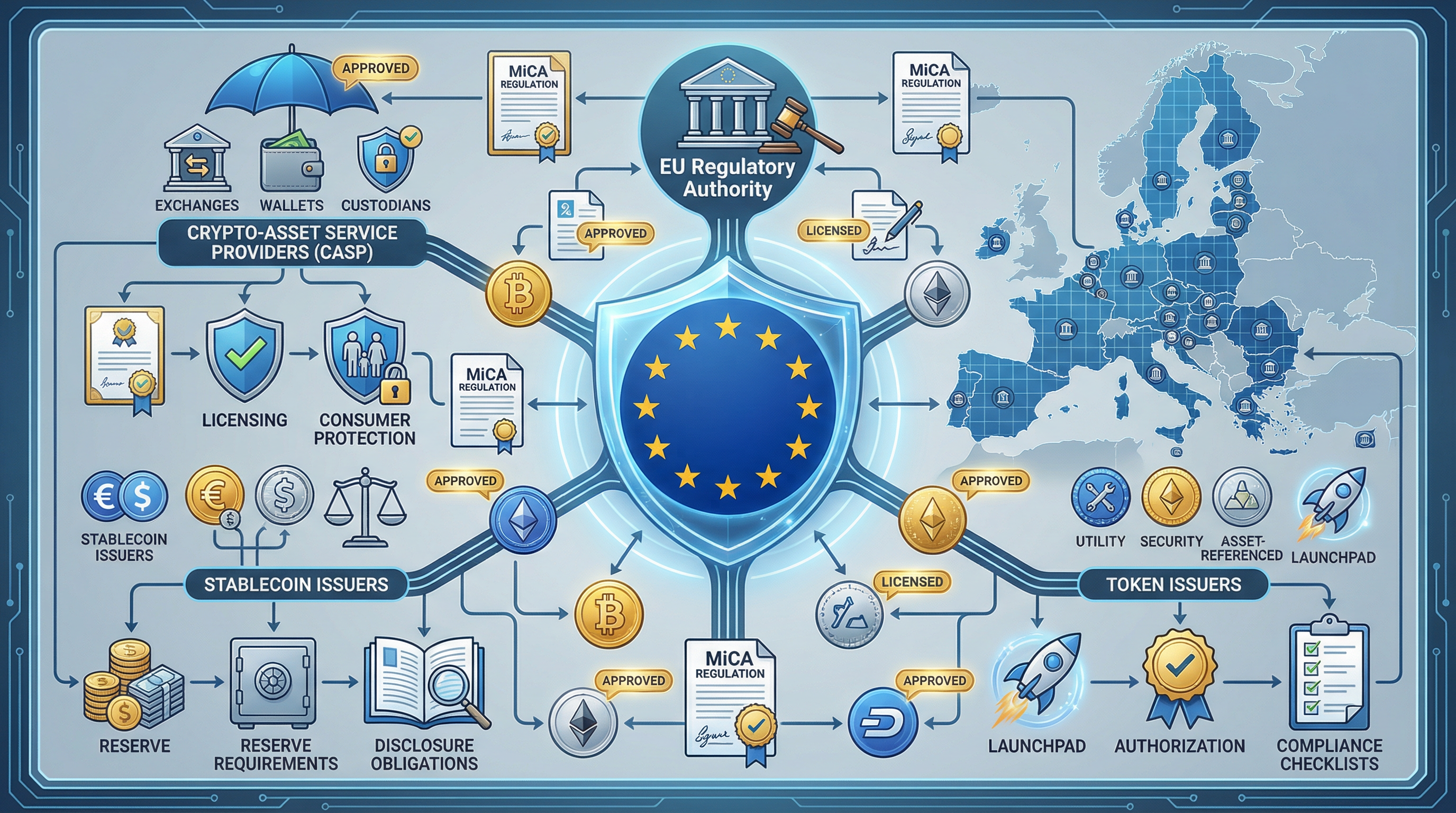

The European Union has established the most comprehensive regulatory framework for crypto-assets to date. This guide provides detailed analysis of MiCA requirements for stablecoins, crypto-asset service providers, and token issuers operating in EU markets.

MiCA Compliance Guide: Navigating the EU's Crypto-Asset Regulatory Framework

The European Union has established the most comprehensive regulatory framework for crypto-assets to date. The Markets in Crypto-Assets Regulation, known as MiCA, represents a fundamental shift in how digital assets are governed across all 27 EU member states. For crypto businesses operating in or serving European markets, understanding and complying with MiCA is no longer optional—it is a legal requirement with significant implications for market access, operational structure, and business strategy.

MiCA entered into force on June 29, 2023, following approval by the European Parliament in April 2023. The regulation implements a phased approach, with stablecoin rules taking effect on June 30, 2024, and comprehensive requirements for crypto-asset service providers becoming fully applicable by July 2026. This timeline creates both urgency and opportunity for businesses to adapt their operations to meet EU standards while maintaining competitive positioning in the European market.

Understanding MiCA's Scope and Objectives

MiCA establishes uniform market rules for crypto-assets that fall outside existing EU financial services legislation. The regulation aims to create legal clarity and certainty for businesses while protecting investors, preventing market manipulation, and reducing the misuse of crypto-assets for illicit purposes. By harmonizing regulatory approaches across all EU jurisdictions, MiCA eliminates the previous fragmented landscape where crypto firms needed multiple licenses to operate across different member states.

The regulation covers three primary categories of crypto-assets, each subject to distinct requirements. Asset-referenced tokens stabilize their value by referencing one or more official currencies or other assets. E-money tokens are backed by a single fiat currency and function similarly to electronic money under existing EU law. All other crypto-assets, including utility tokens that do not qualify as financial instruments under the Markets in Financial Instruments Directive, fall into a third catch-all category with lighter regulatory obligations.

MiCA explicitly excludes certain assets and activities from its scope. Crypto-assets that qualify as financial instruments under MiFID II remain subject to existing securities regulation rather than MiCA. Non-fungible tokens generally fall outside MiCA unless they exhibit characteristics similar to regulated crypto-assets, such as fungibility when issued in large series or fractionalization that creates divisible ownership interests. Fully decentralized protocols without identifiable issuers or service providers also remain outside MiCA's direct reach, though this exclusion requires careful legal analysis given the complexity of determining true decentralization.

Authorization Requirements for Crypto-Asset Service Providers

The most significant impact of MiCA falls on crypto-asset service providers, or CASPs, which must obtain authorization to operate legally within the EU. The regulation defines nine distinct crypto-asset services requiring authorization: custody and administration of crypto-assets on behalf of clients, operating trading platforms, exchange services between crypto-assets and fiat currencies or between different crypto-assets, execution of orders on behalf of clients, placement of crypto-assets, reception and transmission of orders, advice on crypto-assets, portfolio management, and transfer services on behalf of clients.

To obtain CASP authorization, businesses must establish a legal presence within the EU with at least one director who is an EU resident. The registered office must be located in an EU member state, and the application must be submitted to the national competent authority in that jurisdiction. The authorization process requires comprehensive documentation demonstrating adequate organizational structure, governance arrangements, risk management procedures, internal controls, and financial resources to operate safely and soundly.

Once authorized in one EU member state, CASPs benefit from passporting rights that allow them to provide services across all 27 EU jurisdictions without obtaining separate licenses in each country. This single-market approach represents a significant advantage for authorized firms compared to the previous regime where multiple national licenses were often necessary. However, third-country providers face substantial limitations—MiCA does not establish a separate authorization regime for non-EU firms, and active solicitation or promotion of services to EU clients requires full EU authorization. The reverse solicitation exemption, where clients initiate contact without prior marketing, remains available but is expected to be interpreted narrowly.

Operational and Governance Standards for CASPs

Authorized CASPs must comply with extensive operational requirements designed to ensure consumer protection, market integrity, and financial stability. These obligations begin with fundamental conduct standards requiring CASPs to act honestly, fairly, and professionally in the best interests of their clients. This fiduciary-like duty permeates all aspects of CASP operations and creates potential liability for failures to prioritize client interests over firm profits or convenience.

Organizational requirements mandate robust governance structures with clear allocation of responsibilities, effective internal controls, and appropriate segregation of duties. CASPs must implement comprehensive risk management frameworks addressing operational risks, cybersecurity threats, fraud, market manipulation, and conflicts of interest. Business continuity and disaster recovery plans must ensure service availability even during disruptions, with particular attention to the safeguarding of client assets and data.

Capital requirements vary based on the services provided, ranging from €50,000 to €150,000 in permanent minimum capital. CASPs must also maintain professional indemnity insurance or comparable guarantee to cover liability for operational failures, security breaches, or loss of client assets. These prudential requirements ensure that CASPs maintain financial resilience and can compensate clients for losses resulting from firm failures or misconduct.

Client asset protection rules require strict segregation of client crypto-assets and funds from the CASP's own assets. Custodial arrangements must prevent the use of client assets for the firm's own account, and detailed records must track individual client holdings at all times. In the event of CASP insolvency, client assets must be protected from claims by the firm's creditors and returned to clients without delay. These safeguarding requirements represent a significant departure from practices in some jurisdictions where client assets were commingled with firm assets or used for proprietary trading or lending.

Disclosure and Transparency Obligations

MiCA imposes comprehensive disclosure requirements to ensure clients and the public have access to material information about CASPs and the services they provide. CASPs must publicly disclose their fee structures, including all costs and charges associated with their services. This pricing transparency extends to exchange rates, spreads, and any other charges that affect the net value clients receive from transactions.

Marketing communications must be fair, clear, and not misleading. CASPs must ensure that promotional materials accurately represent the services offered, clearly disclose risks, and do not create unrealistic expectations about potential returns or benefits. All marketing must be identifiable as such and must not disguise commercial intent as educational content or independent analysis.

Risk disclosure represents a critical component of CASP obligations. Before providing services, CASPs must furnish clients with clear warnings about the risks associated with crypto-assets, including price volatility, liquidity risk, technology risks, and the potential for total loss of invested capital. For specific transactions, CASPs must provide tailored risk warnings that address the particular characteristics and risks of the crypto-assets involved.

Environmental impact disclosure requirements mandate that CASPs inform clients about the energy consumption and environmental footprint of the crypto-assets they offer. This transparency obligation reflects growing regulatory concern about the sustainability of proof-of-work consensus mechanisms and other energy-intensive blockchain technologies. CASPs must obtain and disclose information about the consensus mechanisms used by the crypto-assets they support and provide estimates of associated energy consumption and carbon emissions.

Market Abuse and Consumer Protection Provisions

MiCA extends market abuse prohibitions familiar from traditional securities regulation to crypto-asset markets. The regulation prohibits insider trading, unlawful disclosure of inside information, and market manipulation in crypto-asset markets. These prohibitions apply to any person possessing inside information or engaging in manipulative conduct, not just to CASPs, creating broad liability for market participants.

Inside information is defined as non-public information that, if made public, would be likely to have a significant effect on the price of crypto-assets. Persons possessing inside information may not use it to trade crypto-assets, disclose it to others, or recommend that others trade based on it. This prohibition creates compliance challenges for crypto projects where development teams, investors, and community members may have access to material non-public information about protocol upgrades, partnerships, or other developments.

Market manipulation prohibitions address a wide range of potentially abusive conduct, including spreading false or misleading information, engaging in wash trading or other fictitious transactions, and manipulating the supply or demand for crypto-assets to affect prices artificially. CASPs must implement systems and controls to detect and prevent market manipulation on their platforms, including transaction monitoring, surveillance for suspicious trading patterns, and reporting of potential abuse to competent authorities.

Consumer protection provisions include a 14-day withdrawal right for retail clients who purchase crypto-assets that are not yet traded on platforms at the time of purchase. This cooling-off period allows consumers to reconsider their investment decisions and obtain refunds without penalty. The withdrawal right reflects regulatory concern about impulsive investment decisions and high-pressure sales tactics in crypto-asset offerings.

Requirements for Asset-Referenced Tokens and E-Money Tokens

Stablecoin issuers face the most stringent requirements under MiCA, reflecting regulatory concerns about financial stability risks posed by widely adopted payment tokens. The regulation distinguishes between asset-referenced tokens, which may reference a basket of currencies or other assets, and e-money tokens, which are backed by a single fiat currency. Both categories require authorization, but the specific requirements and supervising authorities differ.

Issuers of asset-referenced tokens must obtain authorization from the national competent authority in their home member state before offering tokens to the public or seeking admission to trading. The authorization process requires demonstration of adequate capital, robust governance and risk management, and comprehensive reserve management procedures. ART issuers must maintain reserves of high-quality liquid assets with a value at least equal to the outstanding tokens, ensuring that token holders can redeem their holdings at any time.

Reserve composition requirements mandate that ART reserves consist primarily of highly liquid assets with minimal credit and market risk. At least 30% of reserves must be held as deposits with credit institutions, with the remainder invested in highly liquid financial instruments with minimal credit, market, and concentration risk. These requirements ensure that issuers can meet redemption requests even during periods of market stress without forced liquidation of illiquid assets at disadvantageous prices.

E-money token issuers face requirements largely aligned with the existing E-Money Directive, which has governed electronic money institutions in the EU for years. Credit institutions and authorized e-money institutions can issue EMTs after notifying their supervisory authority and publishing a whitepaper. The reserve backing must consist of highly liquid assets denominated in the same currency as the EMT, maintained in segregated accounts that protect token holders in the event of issuer insolvency.

Both ART and EMT issuers may be classified as "significant" based on criteria including the number of holders, market capitalization, transaction volumes, and cross-border activity. Significant token issuers face enhanced supervision by the European Banking Authority, stricter capital requirements, mandatory stress testing, and additional operational resilience standards. The significance classification ensures that stablecoins with systemic importance receive regulatory scrutiny commensurate with their potential impact on financial stability.

One of MiCA's most notable provisions is the effective ban on algorithmic stablecoins. The regulation requires that stablecoins maintain reserves of actual assets backing the tokens, which algorithmic designs relying solely on supply adjustments and arbitrage mechanisms cannot satisfy. This prohibition reflects regulatory skepticism about the stability of algorithmic models following high-profile failures in the crypto market.

Token Issuance and Whitepaper Requirements

For crypto-assets that do not qualify as ARTs or EMTs, MiCA establishes a disclosure-based regime rather than requiring authorization. Issuers must publish a whitepaper containing detailed information about the token, the issuer, the offer, and associated risks. The whitepaper serves as a prospectus providing potential purchasers with the information necessary to make informed investment decisions.

The whitepaper must be notified to the national competent authority in the issuer's home member state at least 20 working days before publication. The authority reviews the whitepaper for completeness and may require modifications to ensure compliance with MiCA's content requirements. However, unlike authorization processes, the competent authority does not assess the merits of the project or approve the token offering—the review focuses solely on disclosure adequacy.

Whitepaper content requirements are extensive and prescriptive. The document must identify the issuer and describe its legal structure, governance, and financial condition. Technical information about the crypto-asset must cover the consensus mechanism, token supply and distribution, smart contract functionality, and any rights or utilities the token provides. Risk disclosures must address technology risks, market risks, legal and regulatory risks, and any other material risks specific to the project.

Marketing communications related to the token offering must be consistent with the whitepaper and clearly identified as promotional material. Issuers bear legal liability for the accuracy and completeness of whitepaper information, creating potential civil liability to purchasers who suffer losses due to misleading or incomplete disclosures. This liability regime incentivizes careful preparation and legal review of offering documents.

Certain token offerings are exempt from whitepaper requirements based on their limited scope or sophisticated investor base. Offerings to fewer than 150 persons per member state, offerings with total consideration not exceeding €1 million over 12 months, and offerings exclusively to qualified investors do not require whitepaper publication. These exemptions recognize that smaller offerings and sales to sophisticated investors present lower consumer protection concerns and can proceed with lighter regulatory burdens.

Cross-Border Passporting and Third-Country Considerations

One of MiCA's most significant benefits for authorized entities is the single-market passport allowing cross-border service provision throughout the EU. Once authorized in their home member state, CASPs can provide services in any other EU jurisdiction by notifying the host state competent authority. This notification process is streamlined and does not require separate authorization or substantive review by the host state authority.

The passport extends to all services covered by the CASP's authorization, allowing firms to offer their full service range across the EU without geographic restrictions. Host member states may not impose additional authorization requirements or substantive conditions on passported services, ensuring regulatory harmonization and preventing fragmentation of the single market. However, host states retain authority to enforce MiCA requirements and may take supervisory action against CASPs operating in their jurisdiction.

For third-country firms, MiCA's approach is notably restrictive compared to some other EU financial services regulations. The regulation does not establish an equivalence regime allowing third-country authorization to substitute for EU authorization, nor does it create a separate third-country CASP category with tailored requirements. Non-EU firms seeking to actively market or provide services to EU clients must establish an EU entity and obtain full CASP authorization.

The reverse solicitation exception provides limited relief for third-country firms. When EU clients initiate contact with a non-EU provider without prior marketing or solicitation, the provider may offer services without EU authorization. However, regulatory guidance suggests this exception will be interpreted narrowly, and any marketing activities targeting EU clients—including general website accessibility or social media presence—may preclude reliance on reverse solicitation.

Implementation Timeline and Transitional Provisions

MiCA's implementation follows a phased approach designed to give market participants time to adapt while ensuring consumer protection and market integrity. The regulation entered into force on June 29, 2023, beginning the clock for various implementation deadlines. Different provisions became applicable at different times based on their complexity and the preparation required for compliance.

Stablecoin provisions took effect on June 30, 2024, requiring ART and EMT issuers to obtain authorization and comply with reserve, disclosure, and operational requirements. Existing stablecoin issuers had to submit authorization applications and could continue operations during the application review period, but new issuers could not commence operations without authorization. This early application date reflects regulatory priority on addressing financial stability risks from stablecoins.

The Transfer of Funds Regulation requirements became applicable on December 30, 2024, mandating that CASPs collect and exchange information about the originators and beneficiaries of crypto-asset transfers. This "travel rule" extends anti-money laundering requirements from traditional finance to crypto-assets, requiring CASPs to implement systems for data collection, verification, and exchange with counterparty CASPs.

General CASP authorization requirements become fully applicable on December 30, 2024, after which providing crypto-asset services without authorization constitutes a violation subject to penalties. However, member states may grant transitional periods allowing existing service providers to continue operations while their authorization applications are pending. These grandfathering periods can extend up to 18 months, until July 1, 2026, though not all member states have chosen to provide the full transitional period.

By July 2026, all transitional provisions expire and full MiCA compliance becomes mandatory for all market participants. CASPs must hold valid authorizations, stablecoin issuers must comply with all reserve and disclosure requirements, and token issuers must have published compliant whitepapers for any ongoing offerings. Entities operating without required authorizations or in violation of MiCA requirements face enforcement action, penalties, and potential inclusion in ESMA's register of non-compliant entities.

Supervisory Architecture and Enforcement

MiCA establishes a multi-layered supervisory architecture combining EU-level authorities with national competent authorities. The European Securities and Markets Authority plays a central coordinating role, developing technical standards and guidelines, maintaining the central register of authorized entities, and directly supervising significant ART and EMT issuers. The European Banking Authority shares responsibility for stablecoin supervision and develops standards for AML compliance and prudential requirements.

National competent authorities in each member state handle day-to-day supervision of CASPs and non-significant token issuers authorized in their jurisdiction. These authorities review authorization applications, conduct ongoing supervision, investigate potential violations, and impose sanctions for non-compliance. National authorities must cooperate with ESMA, EBA, and competent authorities in other member states to ensure consistent application of MiCA across the EU.

Enforcement powers include the authority to impose administrative sanctions and penalties for MiCA violations. Competent authorities can issue cease-and-desist orders, suspend or withdraw authorizations, impose fines, and require disgorgement of profits from violations. Public disclosure of enforcement actions serves both punitive and deterrent functions, warning market participants about prohibited conduct and demonstrating regulatory commitment to enforcement.

ESMA maintains a public register of non-compliant crypto-asset service providers, identifying entities that provide services without required authorization or in violation of MiCA requirements. Inclusion in this register serves as a warning to consumers and other market participants, and member states must take measures to prevent non-compliant entities from providing services to their residents. The register creates reputational consequences for non-compliance and facilitates coordinated enforcement across jurisdictions.

Practical Compliance Strategies

Businesses subject to MiCA should begin compliance preparations well in advance of applicable deadlines. The authorization process for CASPs typically requires several months to complete, and application backlogs at national competent authorities may extend processing times further. Early preparation allows time to address any deficiencies identified during the review process and reduces the risk of operational disruptions from delayed authorization.

The first step in MiCA compliance involves determining which provisions apply to the business. This classification analysis requires careful legal review of the services provided, the nature of any tokens issued or offered, and the geographic scope of operations. Businesses should document their classification analysis and consider obtaining external legal opinions to support their conclusions, particularly for novel business models or borderline cases.

For entities requiring CASP authorization, preparation should focus on developing the governance structures, policies, procedures, and systems required to meet MiCA standards. This includes establishing appropriate management and oversight bodies, implementing risk management and internal control frameworks, developing client asset safeguarding procedures, and creating compliance monitoring and reporting capabilities. Many businesses will need to hire additional compliance personnel or engage external consultants to build these capabilities.

Stablecoin issuers face particularly complex compliance requirements around reserve management, liquidity stress testing, and redemption procedures. These businesses should engage with potential custodians and reserve managers early in the process to ensure appropriate arrangements can be established. Regular audits of reserves and stress testing of redemption capacity should begin before authorization to identify and address any weaknesses in the reserve management framework.

Token issuers must develop comprehensive whitepapers that satisfy MiCA's detailed content requirements while remaining accessible to retail investors. This balance between technical completeness and readability requires careful drafting and often benefits from input by legal counsel, technical experts, and communications professionals. Issuers should also establish processes for updating whitepapers when material changes occur and for ensuring consistency between whitepapers and marketing materials.

Conclusion

MiCA represents a watershed moment in crypto-asset regulation, establishing comprehensive EU-wide standards that will shape the industry for years to come. The regulation provides much-needed legal clarity while imposing substantial compliance obligations on market participants. Businesses that adapt successfully to MiCA requirements will gain access to the European market with the confidence that comes from operating within a clear regulatory framework.

The phased implementation timeline creates both challenges and opportunities. Early movers that obtain authorization and demonstrate compliance may gain competitive advantages as less-prepared competitors struggle to meet requirements. However, the complexity of MiCA compliance should not be underestimated—businesses need adequate time and resources to build the necessary capabilities and should seek expert guidance when needed.

As MiCA implementation progresses, market participants should monitor developments closely. ESMA and national competent authorities continue to publish technical standards, guidelines, and supervisory expectations that clarify MiCA requirements and establish best practices. Staying informed about these developments and adapting compliance programs accordingly will be essential for maintaining regulatory compliance and competitive positioning in the evolving European crypto-asset market.

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.