Blockchain Compliance Blog

Expert insights on cryptocurrency regulations, compliance guides, and tax treatment across global jurisdictions

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.

Regulatory UpdatesJanuary 6, 202625 min read

2025 Global Crypto Regulation: Year in Review

2025 marked a watershed moment in global cryptocurrency regulation. From the EU's MiCA implementation to the US GENIUS Act, this comprehensive review examines the most significant regulatory developments across 30+ jurisdictions and identifies emerging trends shaping 2026.

year in review2025MiCA

Read Article

Compliance GuidesJanuary 6, 202615 min read

Switzerland's Crypto Valley: Complete Guide to FINMA Licensing and the DLT Act

Switzerland pioneered crypto regulation with FINMA oversight and the groundbreaking DLT Act. This comprehensive guide covers licensing pathways (SRO vs FINMA), zero capital gains tax, world-class banking infrastructure, and Crypto Valley's ecosystem advantages.

SwitzerlandFINMADLT Act

Read Article

Compliance GuidesJanuary 6, 202614 min read

UAE VARA vs ADGM: Choosing Your Crypto License in Dubai and Abu Dhabi

The UAE offers multiple pathways for crypto businesses through VARA and ADGM. This comprehensive guide compares both frameworks, covering licensing requirements, costs, tax treatment, banking access, and strategic considerations for choosing the right jurisdiction.

UAEVARAADGM

Read Article

Compliance GuidesJanuary 6, 202615 min read

Complete Guide to Crypto Licensing in Singapore: Navigating MAS Regulations in 2026

Singapore has firmly established itself as Asia's premier cryptocurrency hub. This comprehensive guide covers the MAS regulatory framework, FSMA licensing requirements, tax treatment, banking access, and practical considerations for businesses considering Singapore operations.

SingaporeMASFSMA

Read Article

Regulatory UpdatesDecember 17, 202512 min read

Ripple, Circle, and Three Others Win Federal Banking Charters: What It Means for Crypto's Future

The OCC granted conditional approval for five crypto firms—including Ripple and Circle—to operate as national trust banks. This marks a watershed moment in U.S. crypto regulation, signaling a shift from enforcement to integration.

RippleCircleOCC

Read Article

Regulatory UpdatesNovember 5, 20257 min read

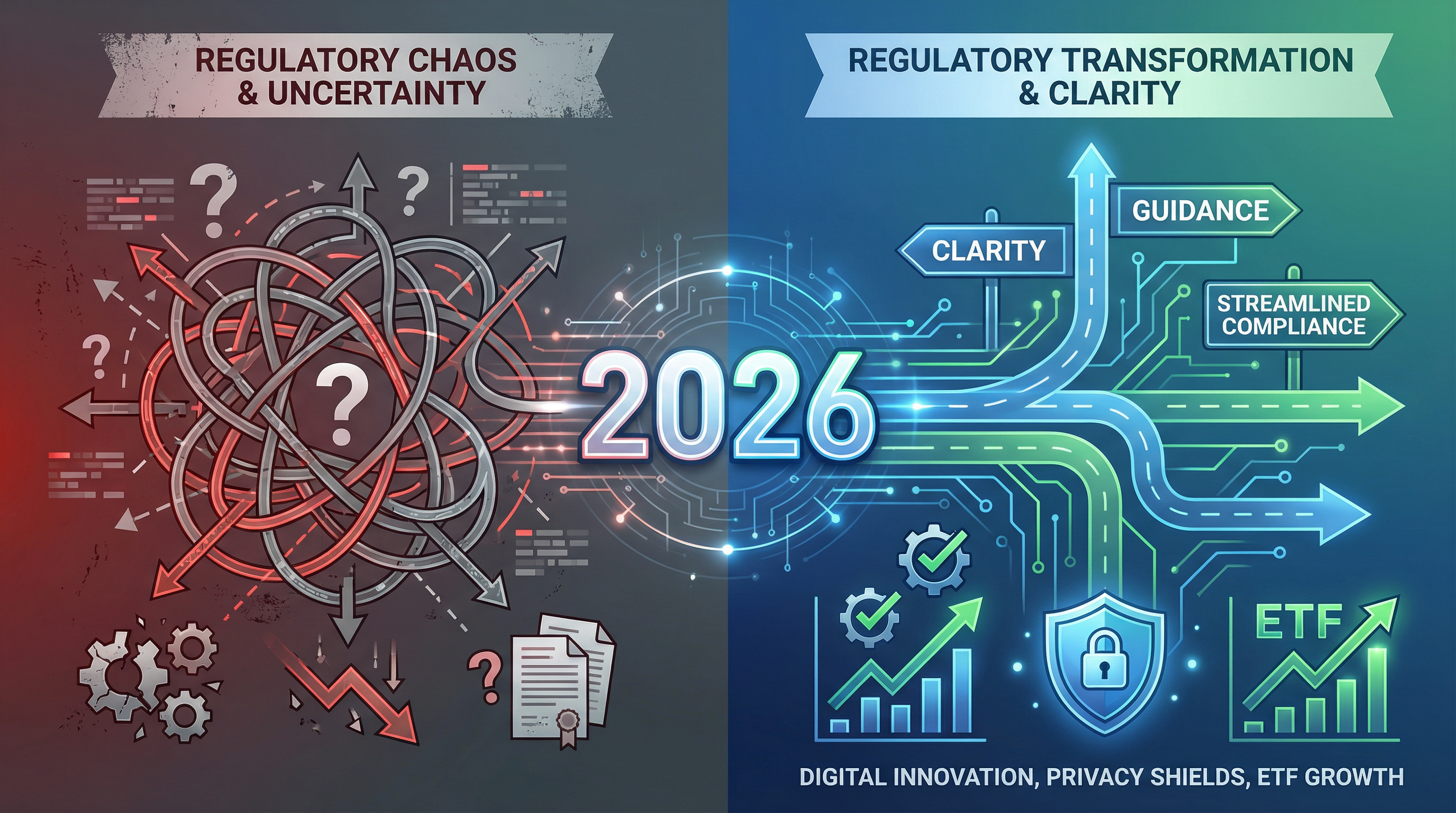

Crypto Regulatory Reset 2026: Compliance, Privacy & ETFs

The year 2026 brings a mix of regulatory clarity and political friction in the crypto sector. Key trends include the institutional adoption of crypto via regulated products like ETFs, the necessity for compliance-friendly privacy tools, and ongoing legislative struggles over market structure and digital identity. Businesses must integrate compliance into product design to meet global standards.

crypto regulation2026 outlookcompliance

Read Article

Regulatory UpdatesOctober 28, 20258 min read

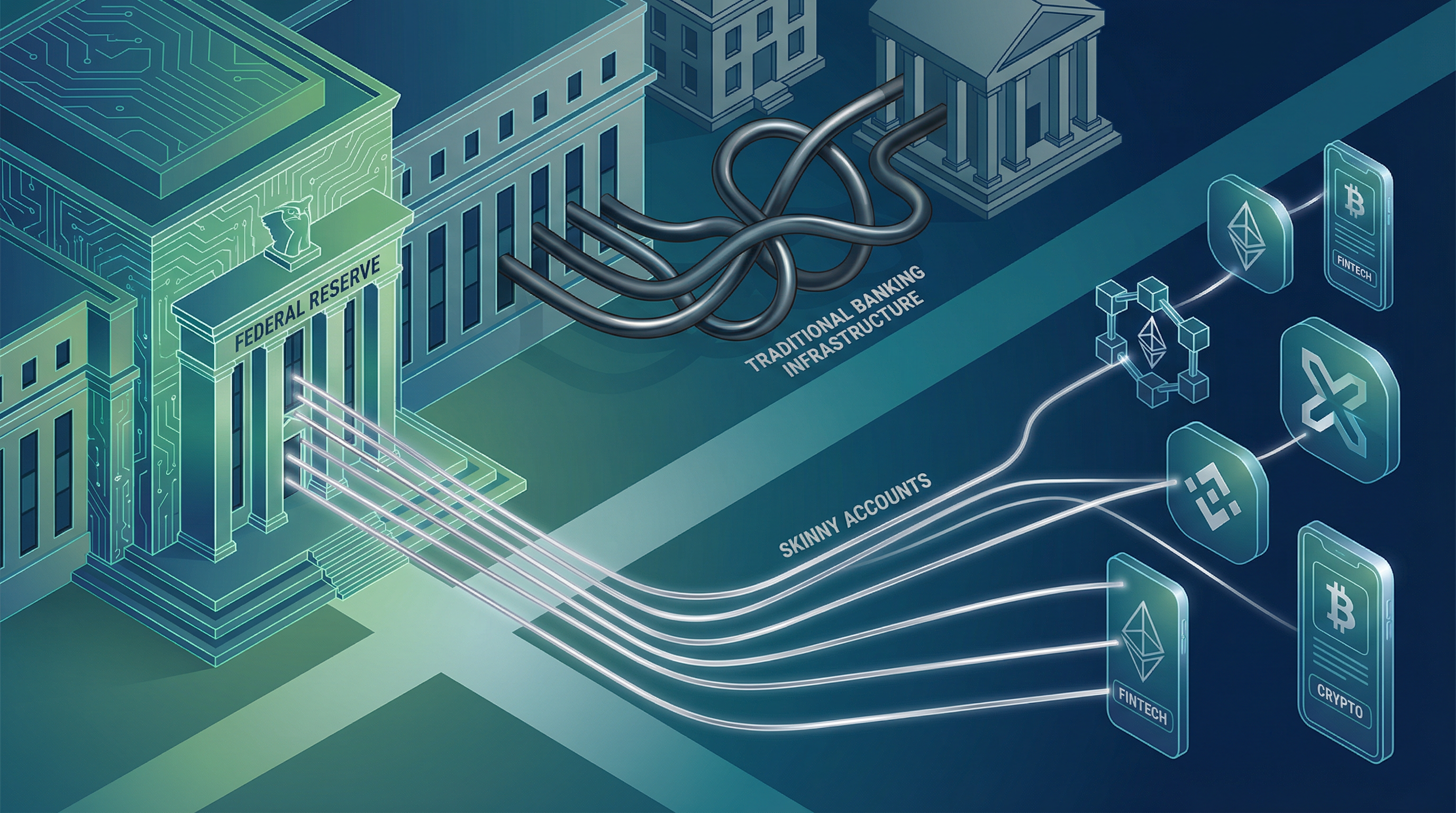

Crypto Regulatory Roundup: Banking Access & Enforcement

The final weeks of 2025 brought significant regulatory movement, notably concerning institutional banking access for crypto firms. The Federal Reserve's potential move toward offering "skinny" accounts could reshape financial interactions. Compliance officers must prepare for intensified enforcement and clearer jurisdictional boundaries between the SEC and CFTC in 2026.

crypto regulationbanking accessFederal Reserve

Read Article

Regulatory UpdatesOctober 7, 202514 min read

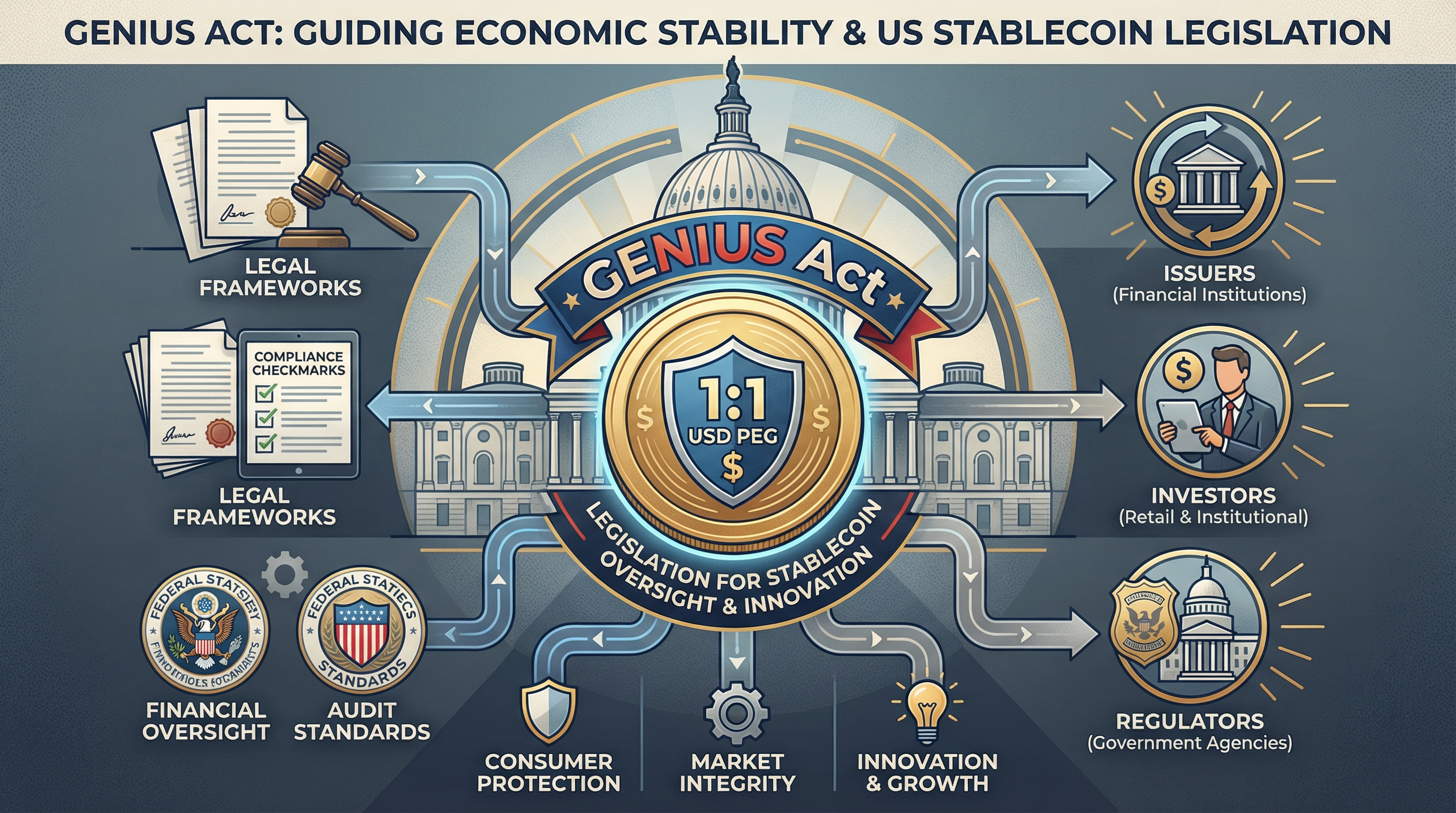

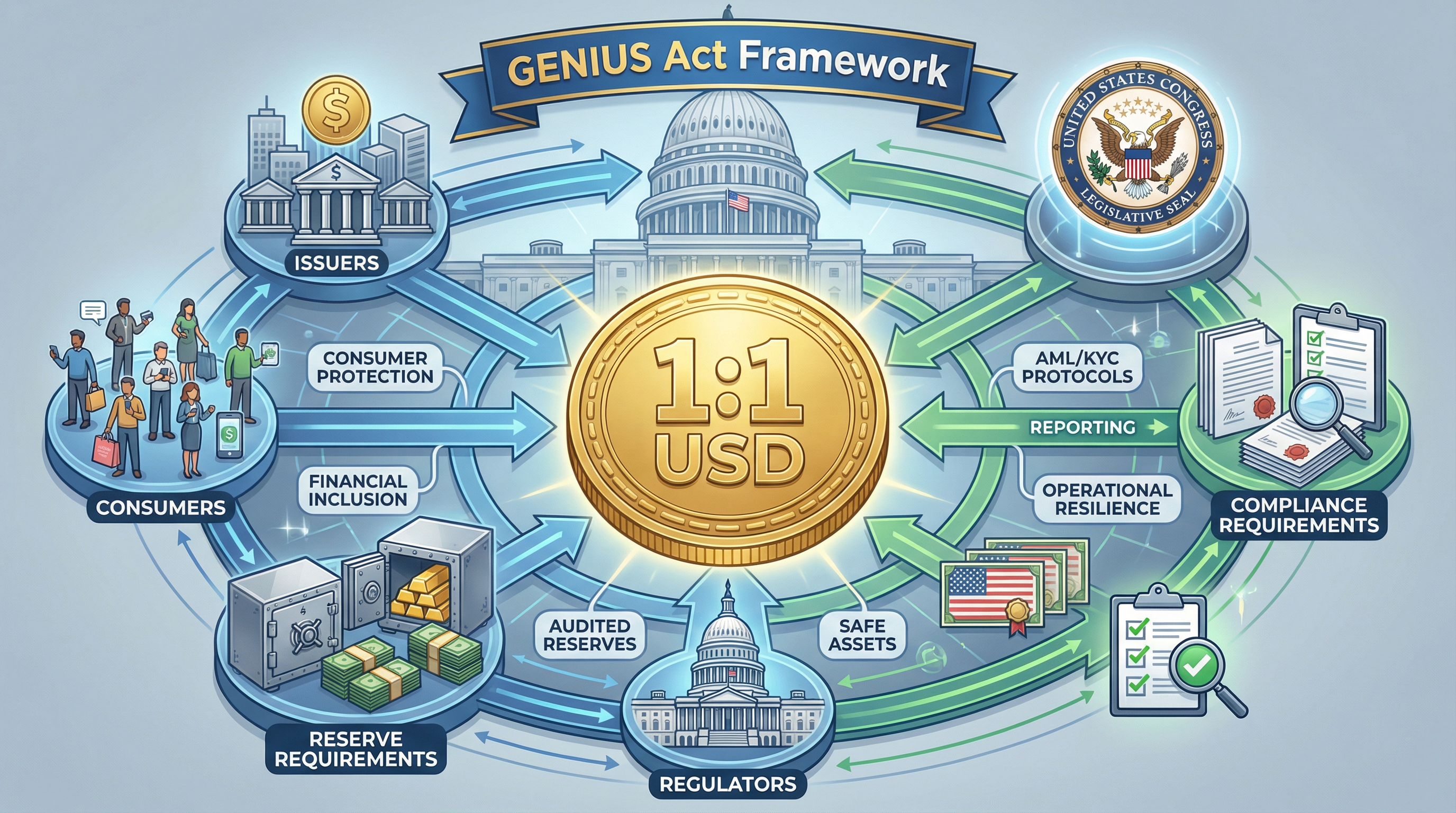

GENIUS Act: Complete Guide to US Stablecoin Regulation

President Trump signed the GENIUS Act into law in July 2025, creating the first federal regulatory framework for stablecoins in the United States. Learn how this landmark legislation affects crypto businesses, consumers, and the global digital asset landscape.

GENIUS Actstablecoin regulationUS crypto law

Read Article

Regulatory UpdatesSeptember 22, 20257 min read

Fed 'Skinny' Accounts & Digital Asset Regulatory Roundup

Welcome to the final regulatory roundup of 2025. This week, the focus is on critical infrastructure and enforcement actions defining operational risk in the digital asset sector. The most impactful development is the Federal Reserve moving forward with 'skinny' accounts, potentially dismantling systemic de-banking concerns. Compliance officers must also prepare for persistent risks like sanctions compliance and developer liability in 2026.

regulatory updatesdigital assetsfederal reserve

Read Article

Regulatory UpdatesSeptember 8, 202514 min read

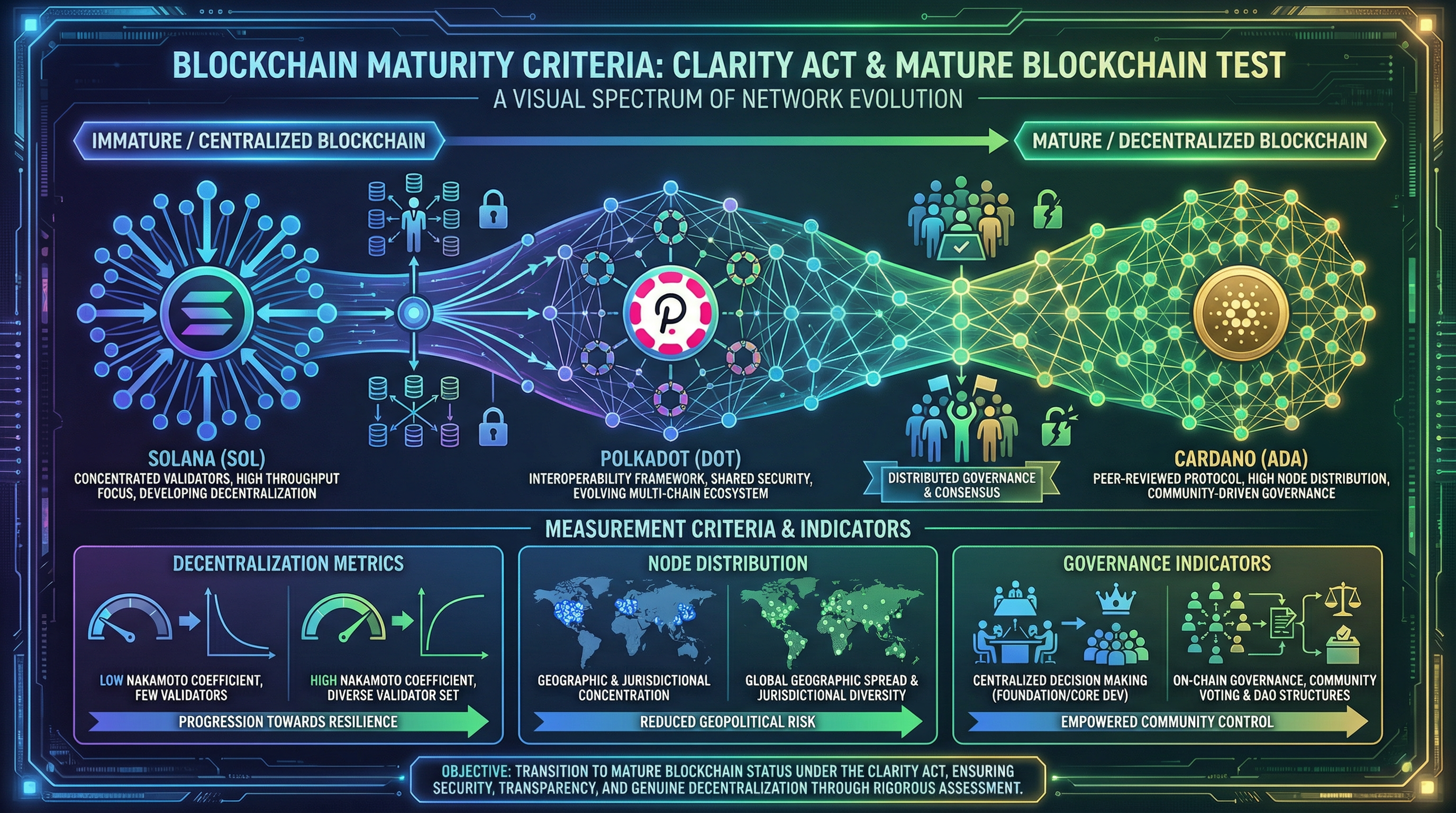

The CLARITY Act's "Mature Blockchain" Test: What It Means for Solana, Cardano, and the Next Generation of Crypto Networks

The CLARITY Act creates a two-tiered regulatory system based on blockchain decentralization. Major networks like Solana, Cardano, and Polkadot currently don't qualify as "mature"—here's what that means for the future of crypto regulation.

["CLARITY Act""US Regulation""Solana"

Read Article

Regulatory UpdatesAugust 5, 202510 min read

GENIUS Act: The Stablecoin Framework That Changes Everything

President Trump signed the GENIUS Act into law on July 18, 2025, creating the first comprehensive federal framework for payment stablecoins. Here's what it means for issuers, investors, and the future of digital dollars.

stablecoinsGENIUS Actfederal regulation

Read Article

Regulatory UpdatesJuly 15, 20256 min read

Crypto Regulatory Roundup: Fed Access & Banking Conflicts

The final weeks of 2025 brought significant clarity and conflict regarding institutional access and consumer protection in the digital asset market. The most impactful development centers on the ongoing struggle for banking access, with Senator Lummis highlighting the potential of the Federal Reserve's "skinny" accounts to provide direct access for crypto companies and fintech startups, potentially ending Operation Chokepoint 2.0.

crypto regulationfederal reservebanking access

Read Article

Compliance GuidesJune 10, 202516 min read

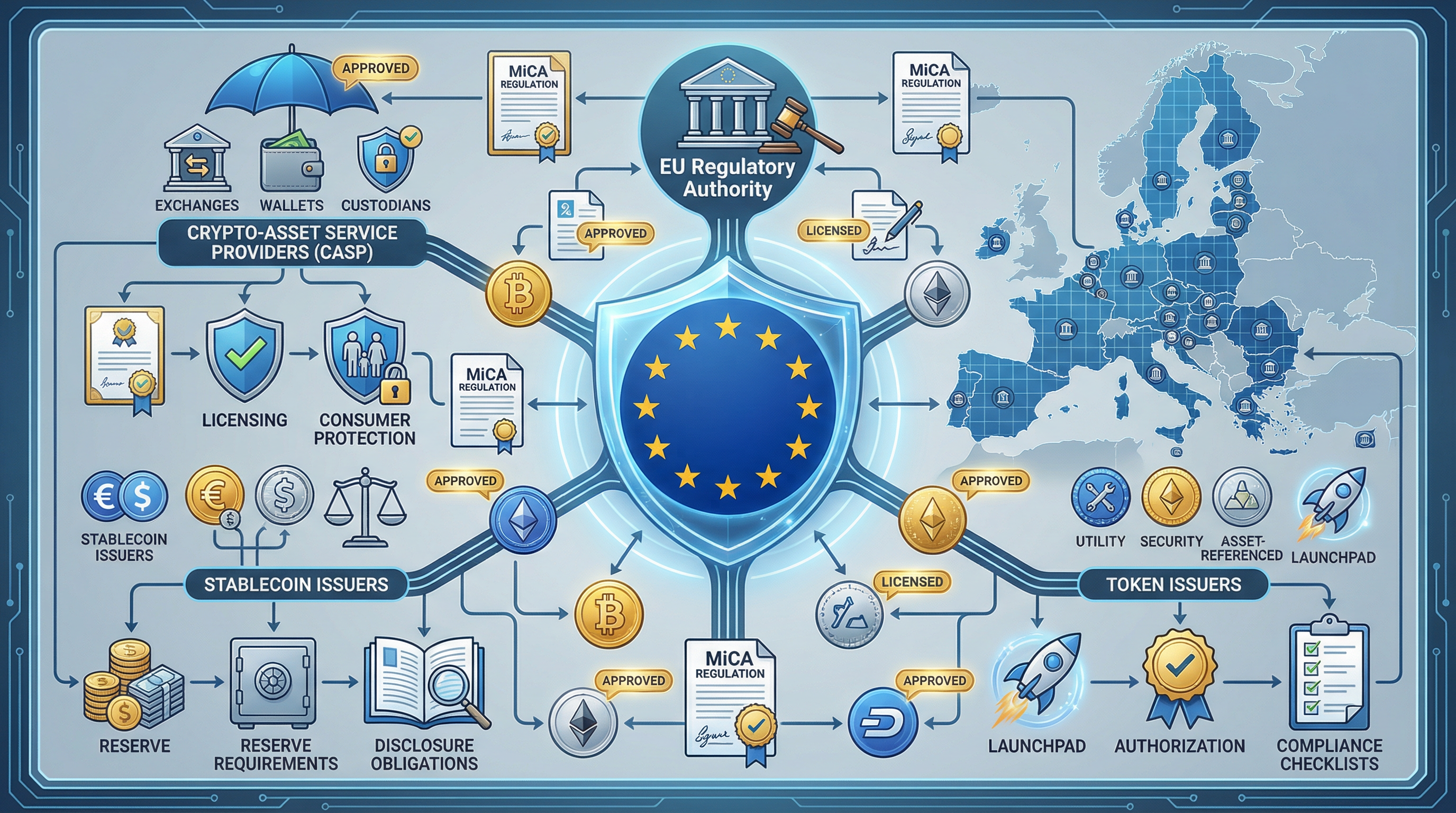

MiCA Compliance Guide: Navigating the EU's Crypto-Asset Regulatory Framework

The European Union has established the most comprehensive regulatory framework for crypto-assets to date. This guide provides detailed analysis of MiCA requirements for stablecoins, crypto-asset service providers, and token issuers operating in EU markets.

MiCAEURegulations

Read Article