GENIUS Act: The Stablecoin Framework That Changes Everything

President Trump signed the GENIUS Act into law on July 18, 2025, creating the first comprehensive federal framework for payment stablecoins. Here's what it means for issuers, investors, and the future of digital dollars.

On July 18, 2025, President Trump signed the GENIUS Act into law. This is the first comprehensive federal framework for payment stablecoins in U.S. history. After years of regulatory uncertainty, stablecoin issuers finally have clear rules.

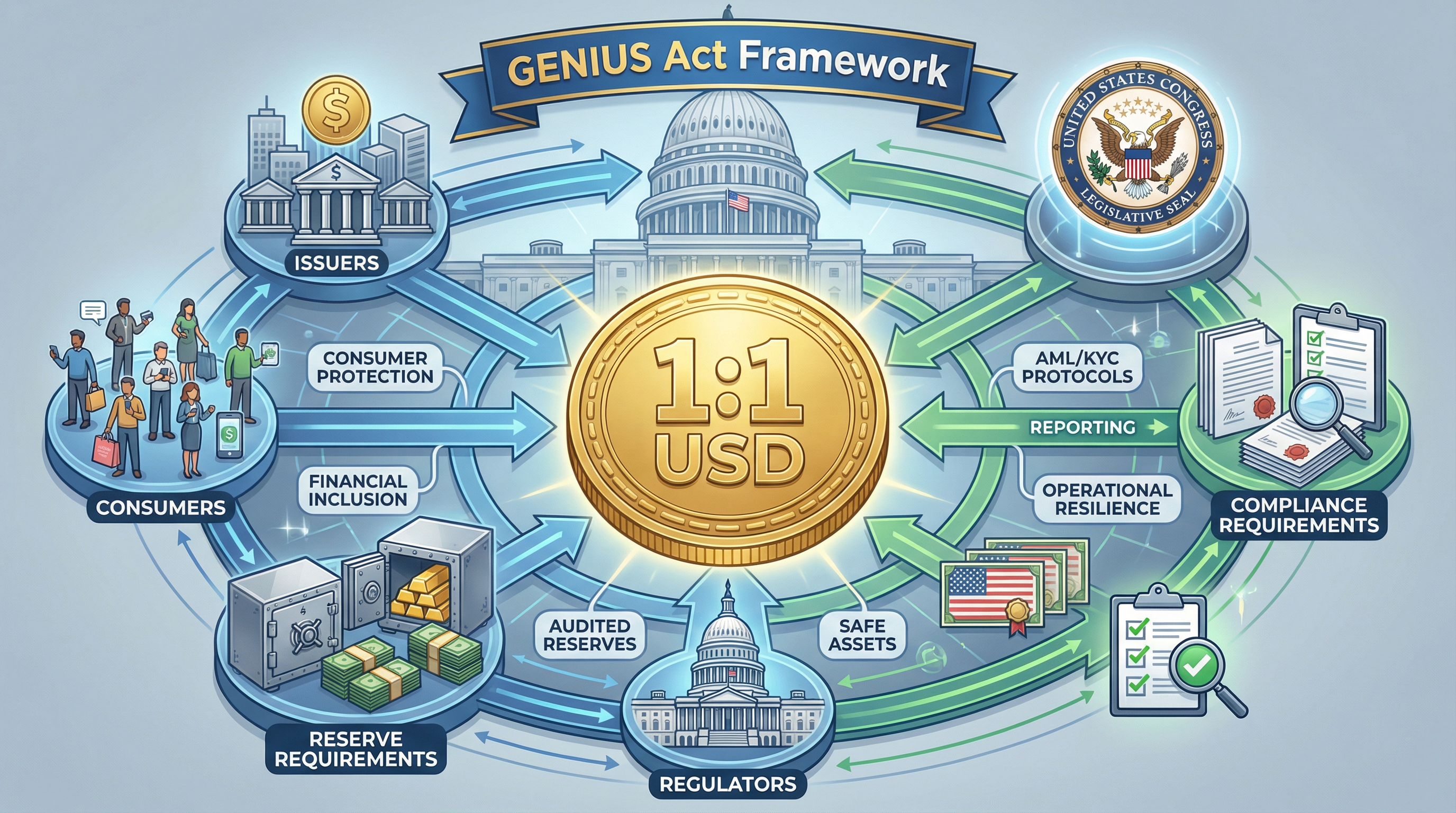

The Guiding and Establishing National Innovation for U.S. Stablecoins Act passed the House on July 17 and the Senate in June. It represents a fundamental shift in how the United States regulates digital assets. The law creates a dual federal-state licensing system, imposes strict reserve requirements, and extends U.S. regulatory reach to foreign issuers serving American customers.

This matters because stablecoins have grown to over $150 billion in market cap without clear federal oversight. The GENIUS Act changes that. It provides legal certainty for compliant issuers while establishing strong consumer protections and national security safeguards.

Who Can Issue Stablecoins Under the GENIUS Act

The law establishes a dual regulatory framework. Both federal and state entities can issue payment stablecoins, but they must meet baseline federal standards.

Federal entities that can issue stablecoins include subsidiaries of federally insured depository institutions like banks and credit unions. This means major banks can now launch stablecoin products through dedicated subsidiaries. Uninsured national banks can also issue stablecoins directly. Nonbank entities can apply to the Office of the Comptroller of the Currency for approval. Federal branches of foreign banks operating in the United States are also eligible.

State-regulated entities can issue stablecoins under state supervision as long as they comply with federal baseline requirements. However, there's a significant threshold. If a state-regulated issuer grows beyond $10 billion in outstanding stablecoins, they must transfer to federal regulation. This prevents systemically important issuers from operating under lighter state oversight.

The dual framework is designed to promote innovation through state experimentation while maintaining uniform safety standards. Smaller issuers can work with state regulators who may be more accessible and responsive. Larger issuers face direct federal supervision with the resources and expertise to manage systemic risks.

Reserve Requirements: 100% Backing with Liquid Assets

The GENIUS Act imposes strict reserve requirements that go beyond what many stablecoin issuers currently maintain. Every payment stablecoin must be backed one-to-one with permitted liquid assets.

Permitted reserve assets include U.S. dollars held in physical currency or demand deposits at federally insured depository institutions. Short-term U.S. Treasury obligations qualify, which means Treasury bills and similar instruments. Balances held directly at the Federal Reserve are also permitted. These are the only acceptable reserve assets.

Issuers must hold reserves in segregated accounts separate from their operational funds. This ensures that customer funds remain protected even if the issuer faces financial difficulties. Regular third-party audits by registered public accounting firms are mandatory. Issuers must provide monthly public disclosures showing the composition of their reserves and confirming they maintain full backing.

The law explicitly prohibits algorithmic stablecoins from being classified as payment stablecoins, even if they claim to maintain one-to-one backing. This addresses concerns about algorithmic mechanisms that can fail under stress, as seen with the Terra/Luna collapse in 2022.

These requirements are designed to ensure stability. If every stablecoin is fully backed by liquid, low-risk assets, the risk of a bank run scenario drops significantly. Holders can redeem their stablecoins for dollars at any time without depending on complex algorithms or illiquid collateral.

Compliance Obligations: AML, Sanctions, and Technical Controls

All payment stablecoin issuers must comply with the Bank Secrecy Act. This means implementing comprehensive anti-money laundering and countering the financing of terrorism programs. Issuers must conduct risk assessments, verify customers against sanctions lists, and maintain customer identification programs.

The law subjects issuers to Office of Foreign Assets Control sanctions requirements. They must screen transactions and block or reject payments involving sanctioned individuals, entities, or jurisdictions. This aligns stablecoin regulation with existing financial sector obligations.

Federal and state regulators have examination authority. They can conduct periodic reviews of issuer operations, compliance programs, and financial condition. When they identify unsafe or unlawful activity, they can bring enforcement actions to restrict or prohibit that activity.

One of the most significant provisions requires issuers to possess the technical capability to seize, freeze, or burn payment stablecoins when legally required. This means stablecoin smart contracts must include functionality allowing issuers to comply with lawful orders from courts or regulators. While this may concern privacy advocates, it's a practical requirement for operating within the regulated financial system.

The law prohibits issuers from paying interest or yield on stablecoins. This distinguishes payment stablecoins from investment products and keeps them focused on their core function as a means of payment and settlement.

Consumer Protections and Marketing Restrictions

The GENIUS Act includes strong consumer protections designed to prevent misleading marketing and ensure holders are protected in insolvency scenarios.

Issuers must comply with strict marketing rules. They cannot make misleading claims that their stablecoins are backed by the U.S. government, federally insured, or legal tender. These restrictions prevent confusion about the nature and risks of stablecoins. A stablecoin is not the same as a bank deposit with FDIC insurance, and the law ensures issuers communicate that clearly.

In the event of issuer insolvency, stablecoin holders' claims are prioritized over all other creditors. This provides a final backstop of consumer protection. If an issuer fails, stablecoin holders have first claim on the reserve assets. This priority treatment is similar to how customer funds are protected in broker-dealer insolvencies.

The law aligns state and federal stablecoin frameworks to ensure fair and consistent regulation throughout the country. This prevents regulatory arbitrage where issuers shop for the most lenient jurisdiction. Baseline federal standards apply everywhere.

Extraterritorial Reach: Foreign Issuers Serving U.S. Customers

The GENIUS Act has significant implications for foreign stablecoin issuers. U.S. regulators can exercise jurisdiction over any entity that issues stablecoins to persons located in the United States.

Foreign issuers serving U.S. customers must adhere to anti-money laundering standards, sanctions requirements, and consumer protection rules. They may be subject to federal registration, disclosure obligations, and compliance requirements. The law extends U.S. regulatory reach beyond domestic borders.

This creates compliance challenges for foreign issuers. They must assess whether their operations impact U.S. markets or consumers. If so, they need to build compliance infrastructure that meets U.S. standards or exit the U.S. market. Many foreign issuers will need to establish U.S. entities or partnerships to maintain access to American customers.

The extraterritorial provisions reflect the global nature of stablecoin markets. Stablecoins cross borders instantly. A foreign issuer can serve millions of U.S. customers without a physical presence in the United States. The GENIUS Act ensures those issuers don't escape U.S. regulatory oversight.

Strategic Implications: Dollar Dominance and National Security

The GENIUS Act serves broader strategic objectives beyond consumer protection and financial stability. It's designed to cement the U.S. dollar's status as the global reserve currency and enhance national security.

By requiring stablecoin issuers to back their assets with U.S. dollars and Treasury obligations, the law drives demand for U.S. debt. As stablecoin adoption grows globally, more capital flows into Treasuries. This supports U.S. government financing and reinforces the dollar's central role in the international financial system.

The law positions the United States as the leader in digital asset regulation. Clear rules attract investment and innovation. Companies that might have considered offshore jurisdictions now have a path to operate compliantly in the United States. This brings economic activity, jobs, and tax revenue to America.

From a national security perspective, the law enhances the Treasury Department's ability to combat illicit finance. Stablecoin issuers must implement sanctions screening and transaction monitoring. They must have technical controls to freeze or seize assets when legally required. This makes stablecoins less attractive for sanctions evasion and money laundering compared to unregulated alternatives.

The law also addresses concerns about stablecoins undermining monetary policy. By prohibiting interest payments and requiring full reserve backing, stablecoins function as a payment rail rather than a competing monetary system. They complement rather than threaten the existing financial infrastructure.

Implementation Timeline and Next Steps

While the GENIUS Act took immediate effect upon signing, key compliance obligations will be detailed in regulations issued by federal agencies. The law directs the Federal Reserve, OCC, and Treasury Department to issue regulations within 180 days of enactment.

This means we should expect proposed rules by mid-January 2026. After a public comment period and final rulemaking, the regulations will likely become operational by mid-2026. Issuers have time to prepare, but they should start now.

Entities currently issuing or planning to issue stablecoins should take immediate action. First, conduct a licensing analysis. Determine whether your entity qualifies for federal or state licensure and which pathway makes sense for your business model. Begin preparing application materials.

Second, assess your compliance programs. Conduct gap analyses comparing your current AML, sanctions, and customer identification procedures against Bank Secrecy Act requirements. Identify needed changes and start implementing them.

Third, review your reserve structures. If you're not maintaining 100% backing with permitted liquid assets in segregated accounts, you need to restructure. Work with auditors to establish monthly disclosure processes.

Fourth, align your operations with disclosure and audit mandates. Set up systems for monthly public reporting of reserve composition. Engage a registered public accounting firm to conduct regular audits.

Fifth, review your smart contract architecture. Ensure you have technical capabilities to freeze, seize, or burn stablecoins when legally required. If your current contracts lack these controls, you'll need to upgrade or migrate to compliant versions.

The Broader Regulatory Landscape

The GENIUS Act is part of a larger push for crypto regulation in 2025. Congress held an unofficial "Crypto Week" in July with multiple bills advancing through both chambers.

The House is moving forward with the CLARITY Act, which would establish standards for cryptocurrency market structure regulation. This addresses questions about which digital assets are securities, how exchanges should be regulated, and what disclosure requirements apply to token issuers.

The Senate is considering its own version of market structure legislation. There are differences between the House and Senate approaches, but both chambers recognize the need for clear rules.

Some House conservatives are pushing legislation to ban a Central Bank Digital Currency. They argue that a government-issued digital dollar could threaten privacy and enable financial surveillance. This debate will continue alongside the implementation of the GENIUS Act.

Together, these legislative efforts represent the most significant federal action on digital assets since Bitcoin launched in 2009. The regulatory landscape is shifting from fragmented state-by-state approaches and enforcement actions toward comprehensive federal frameworks.

What This Means for the Industry

The GENIUS Act provides the clarity that stablecoin issuers have requested for years. No more operating in regulatory gray areas or relying on state money transmitter licenses that vary widely. There's now a clear federal pathway.

Compliant issuers will benefit from regulatory certainty. They can raise capital, build partnerships with banks, and scale their operations without constant legal risk. Institutional adoption should accelerate as banks and payment processors gain confidence that stablecoin rails are properly regulated.

Non-compliant issuers face a choice. They can come into compliance, exit the U.S. market, or face enforcement action. The law gives regulators clear authority to act against issuers that don't meet the standards.

For consumers and businesses using stablecoins, the law provides important protections. You can have greater confidence that regulated stablecoins are actually backed by reserves and subject to oversight. The risk of a sudden collapse or inability to redeem drops significantly.

For the broader crypto industry, the GENIUS Act is a positive signal. It shows that Congress can pass thoughtful digital asset legislation with bipartisan support. It demonstrates that the United States is committed to being a leader in this space rather than ceding it to other jurisdictions.

The law isn't perfect. Some will argue the reserve requirements are too restrictive or that the technical controls compromise decentralization. Others will say the law doesn't go far enough on consumer protection or environmental considerations. But it's a workable framework that balances innovation with safety.

Looking Ahead

The next six months will be critical. Federal agencies must draft and finalize regulations implementing the GENIUS Act. Industry participants should engage in the rulemaking process through public comments. The details matter.

Questions remain about how the law interacts with existing securities and commodities regulations. If a stablecoin meets the GENIUS Act definition but also has characteristics of a security, which regulatory framework applies? Agencies will need to coordinate to avoid conflicts.

International coordination will be important. The European Union has its own stablecoin framework under the Markets in Crypto-Assets Regulation. The GENIUS Act brings U.S. regulation closer to alignment with MiCA, but differences remain. Cross-border issuers will need to navigate both regimes.

The law's extraterritorial provisions may face legal challenges from foreign issuers or governments. Questions about jurisdiction and enforcement across borders will need to be resolved through litigation or international agreements.

Despite these uncertainties, the GENIUS Act represents a major step forward. The United States now has a federal stablecoin framework. That's significant progress. The law provides a foundation that can be refined and improved as the market evolves and new issues emerge.

For anyone working in crypto, payments, or financial services, the GENIUS Act is required reading. It will shape the industry for years to come.

Sources

White House, Treasury Department, Office of the Comptroller of the Currency, Federal Reserve, Congress.gov, Pillsbury Law, Wilson Sonsini

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.

Related Articles