The CLARITY Act's "Mature Blockchain" Test: What It Means for Solana, Cardano, and the Next Generation of Crypto Networks

The CLARITY Act creates a two-tiered regulatory system based on blockchain decentralization. Major networks like Solana, Cardano, and Polkadot currently don't qualify as "mature"—here's what that means for the future of crypto regulation.

The CLARITY Act's "Mature Blockchain" Test: What It Means for Solana, Cardano, and the Next Generation of Crypto Networks

The United States House of Representatives made history in July 2025 by passing the CLARITY Act (H.R. 3633), a landmark piece of legislation that aims to resolve years of regulatory ambiguity in the digital asset space. While much attention has focused on the bill's potential to provide certainty for Bitcoin and Ethereum, a closer examination reveals a more complex reality: the Act's "mature blockchain" classification creates a two-tiered regulatory system that could fundamentally reshape the competitive landscape of the cryptocurrency industry.

At the heart of this transformation lies a deceptively simple definition that carries profound implications for billions of dollars in digital assets and the projects building the next generation of blockchain infrastructure. The question is no longer just whether crypto will be regulated, but rather which blockchains will enjoy the lighter regulatory treatment reserved for "mature" systems—and which will face the full weight of securities law enforcement.

Understanding the "Mature Blockchain" Standard

The CLARITY Act introduces a legal framework that distinguishes between digital assets based on the decentralization of their underlying blockchain networks. According to Section 101(31) of the proposed legislation, a "mature blockchain system" is defined as "a blockchain system, together with its related digital commodity, that is not controlled by any person or group of persons under common control."

This definition, while concise, establishes a high bar for decentralization that goes beyond mere technical architecture. The Act's criteria align with existing regulatory frameworks used by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to evaluate whether digital assets should be classified as securities or commodities.

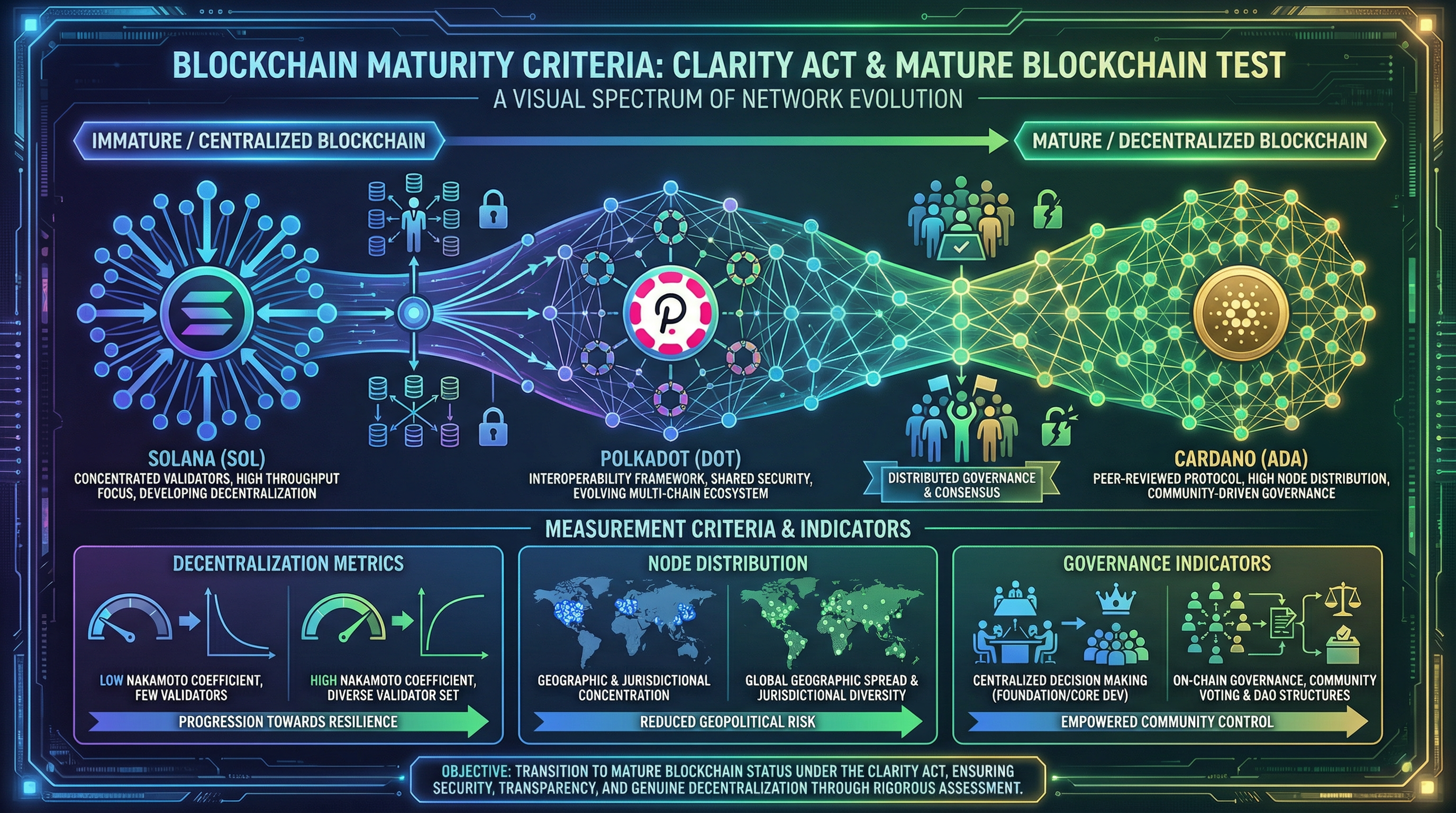

To qualify as mature, a blockchain must demonstrate five key characteristics. First, governance decisions must be made through genuinely decentralized processes, with no single entity or coordinated group exercising unilateral control over protocol upgrades or operational decisions. Second, network consensus must be open to broad participation, whether through proof-of-work mining or proof-of-stake validation, without gatekeeping by centralized parties. Third, the protocol's source code must be transparent and publicly accessible, allowing independent verification and community-driven development. Fourth, there must be an absence of common control by founders, development companies, or affiliated foundations that could coordinate actions affecting the network. Finally, no dominant party should possess unilateral authority to implement changes without community consensus.

These criteria represent more than technical requirements—they embody a regulatory philosophy that treats truly decentralized networks as infrastructure rather than investment vehicles. Blockchains that meet this standard earn classification as "digital commodities" under CFTC jurisdiction, escaping the more stringent securities regulations that govern investment contracts.

The Winners: Networks That Pass the Maturity Test

Analysis of major blockchain networks against the CLARITY Act's criteria reveals a surprisingly short list of projects that currently qualify as mature. Bitcoin, unsurprisingly, serves as the archetype of decentralization. With no central authority, no controlling foundation, and governance entirely distributed among its mining community and independent developers, Bitcoin clearly meets every criterion. No person or group controls protocol changes, and the network's open-source nature ensures transparency and community oversight.

Ethereum, despite its transition to proof-of-stake and the Ethereum Foundation's continued existence, also qualifies as mature. The network's governance operates through community-driven Ethereum Improvement Proposals (EIPs), with control widely distributed across thousands of independent validators. The robust ecosystem of decentralized autonomous organizations (DAOs) further demonstrates that no single party can dictate the network's direction. The Ethereum Foundation's role has evolved from central coordinator to one voice among many in a genuinely decentralized ecosystem.

Beyond these two giants, several smaller networks also meet the maturity standard. Litecoin, derived from Bitcoin's codebase, operates with a decentralized mining system and no centralized foundation managing development. Monero, the privacy-focused cryptocurrency, is developed and maintained by a pseudonymous, volunteer-driven community with no identifiable controlling party. Even Dogecoin, which began as a meme, now operates with a decentralized group of developers and proof-of-work consensus that lacks any central control structure.

Tezos stands out as a proof-of-stake network that achieves maturity through its on-chain governance mechanism, which gives stakeholders direct control over protocol upgrades without requiring approval from a central authority. Similarly, Cosmos Hub operates with decentralized validator governance and open-source development, with the Interchain Foundation no longer maintaining controlling influence over network decisions.

The Excluded: Major Networks Falling Short

The list of networks that do not currently qualify as mature includes some of the industry's most prominent and well-capitalized projects, revealing the stringent nature of the CLARITY Act's standards. Solana, despite its technical innovations and growing ecosystem, faces significant hurdles in achieving mature status. Solana Labs and the Solana Foundation continue to play major roles in development decisions and validator influence. More critically, high token concentration among insiders and early investors creates a structure where a coordinated group maintains effective control over the network's direction. This centralized influence violates the Act's core requirement that no group under common control should dominate the blockchain.

Cardano presents a similar challenge. While the project has made progress toward decentralized governance through initiatives like Project Catalyst, Input Output Hong Kong (IOHK) and the Cardano Foundation currently exert significant influence over development priorities and protocol upgrades. The roadmap toward full decentralization suggests that Cardano may eventually achieve mature status, but under current governance structures, it falls short of the CLARITY Act's requirements.

Polkadot's sophisticated governance model, which includes on-chain voting and a council system, might appear to satisfy decentralization criteria at first glance. However, the Web3 Foundation and Parity Technologies—entities under common control—continue to heavily influence key decisions about the network's development and parachain auctions. This affiliated control structure places Polkadot squarely in the non-mature category, subjecting DOT tokens to potential securities classification.

BNB Chain faces perhaps the clearest case of centralized control among major networks. Binance, the cryptocurrency exchange, maintains significant authority over validator selection, network upgrades, and operational decisions. This direct corporate control fundamentally contradicts the CLARITY Act's vision of a mature blockchain system, making BNB's classification as a security almost certain under the proposed framework.

Avalanche, despite its innovative subnet architecture and growing DeFi ecosystem, remains under considerable influence from Ava Labs. The company retains authority over upgrade paths, validator economics, and key protocol decisions, preventing AVAX from achieving the decentralization required for mature status.

Regulatory Implications: A Two-Tiered System Emerges

The practical consequences of the mature blockchain classification extend far beyond abstract legal categories. For networks that achieve mature status, the regulatory path forward becomes significantly clearer and less burdensome. These digital assets would be classified as commodities under CFTC jurisdiction, benefiting from a regulatory framework designed for fungible goods rather than investment securities. The CFTC's approach emphasizes market integrity, fraud prevention, and manipulation deterrence, but does not impose the registration requirements, disclosure obligations, and ongoing reporting burdens that characterize securities regulation.

This lighter regulatory treatment translates directly into competitive advantages. Mature blockchain tokens can be listed on exchanges without triggering securities registration requirements. Institutional investors can custody and trade these assets without navigating the complex web of broker-dealer regulations. Developers can create derivative products, lending protocols, and other financial innovations without fear that each new use case will trigger securities law scrutiny. The regulatory clarity itself becomes a valuable asset, reducing legal risk and compliance costs while increasing institutional confidence.

For non-mature blockchains, the regulatory landscape looks dramatically different. Classification as securities subjects these digital assets to the full apparatus of federal securities law, including registration requirements for token offerings, ongoing disclosure obligations, and potential liability for past unregistered sales. Projects that conducted initial coin offerings (ICOs) or token sales without securities registration could face enforcement actions, even if those sales occurred years ago. The SEC's position that most crypto tokens constitute securities would gain explicit statutory support, ending years of legal ambiguity in favor of strict regulatory oversight.

The compliance costs alone could prove prohibitive for smaller projects. Securities registration requires extensive legal documentation, financial audits, and ongoing reporting that can cost millions of dollars. Many blockchain projects that operated in regulatory gray areas would face a stark choice: undertake expensive compliance efforts, restructure governance to achieve mature status, or cease operations in the United States market entirely.

The Decentralization Imperative: A Roadmap for Non-Mature Projects

For blockchain projects currently classified as non-mature, the CLARITY Act creates powerful incentives to pursue genuine decentralization. The regulatory benefits of achieving mature status—lighter oversight, reduced compliance costs, and institutional legitimacy—provide concrete business reasons to cede centralized control. This represents a significant shift from the current environment, where many projects maintain centralized governance structures to facilitate rapid development and decision-making.

The path to maturity requires fundamental changes to governance structures, token distribution, and organizational control. Projects must implement mechanisms that transfer decision-making authority from foundations and core development teams to token holders and network participants. This might involve creating robust DAO structures with binding on-chain governance, establishing clear processes for community-driven protocol upgrades, or implementing time-locked transitions that gradually reduce founder influence.

Token distribution presents another critical challenge. Many blockchain projects allocated significant percentages of their token supply to founders, early investors, and affiliated entities. These concentrated holdings create the potential for coordinated control that disqualifies networks from mature status. Achieving maturity may require implementing vesting schedules that distribute tokens more broadly over time, creating mechanisms to dilute insider holdings, or establishing governance structures that limit the voting power of large token holders.

Foundation influence must also be addressed. Many blockchain projects operate through non-profit foundations that coordinate development, fund ecosystem growth, and represent the project in legal and regulatory matters. While these foundations serve important functions, their continued control over key decisions prevents networks from achieving mature status. Projects must find ways to transition foundation roles from central coordinators to service providers operating at the direction of decentralized governance processes.

The timeline for achieving maturity varies significantly across projects. Networks with existing DAO structures and broad token distribution may achieve mature status within months of implementing governance reforms. Projects with concentrated token holdings and strong foundation control may require years of gradual transition. Some networks may never achieve maturity, either because their technical architecture requires centralized coordination or because stakeholders prioritize development speed over regulatory classification.

Market Dynamics: Competitive Advantages and Strategic Responses

The CLARITY Act's two-tiered system creates immediate competitive dynamics that could reshape the blockchain industry. Networks that achieve mature status gain significant advantages in attracting institutional capital, exchange listings, and mainstream adoption. The regulatory clarity alone reduces risk premiums that institutional investors apply to crypto assets, potentially driving capital flows toward mature blockchains and away from projects facing securities classification.

This dynamic has already begun to manifest in market behavior. Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have seen increased institutional adoption as regulatory frameworks have clarified their commodity status. The introduction of Bitcoin and Ethereum exchange-traded funds (ETFs) in 2024 and 2025 demonstrated the market demand for regulated exposure to mature blockchain assets. The CLARITY Act would formalize and expand this trend, potentially creating a class of "regulatory winners" that dominate institutional portfolios.

For non-mature blockchains, the competitive pressure to achieve mature status intensifies. Projects that successfully transition to decentralized governance could see significant market appreciation as they move from the securities category to the commodity category. This creates a race among major blockchain projects to demonstrate genuine decentralization, potentially accelerating governance innovations and token distribution mechanisms.

However, not all projects will pursue maturity. Some blockchain networks may conclude that the benefits of centralized coordination—faster development, clearer accountability, and unified strategic direction—outweigh the regulatory advantages of mature status. These projects might focus on markets outside the United States, pursue securities registration to operate legally within the existing framework, or target use cases where securities classification poses fewer obstacles.

The venture capital landscape also faces significant shifts. The 44% increase in U.S. crypto venture capital observed in 2025 reflects growing confidence in clearer regulatory frameworks. The CLARITY Act would likely accelerate this trend, but with important caveats. Investors may increasingly favor projects with credible paths to mature status, avoiding networks with governance structures that lock in securities classification. This could disadvantage innovative projects that require centralized coordination during early development phases, potentially stifling experimentation in favor of proven decentralization models.

Global Context: Alignment and Divergence in Crypto Regulation

The CLARITY Act does not exist in isolation but rather forms part of a global wave of cryptocurrency regulation that gained momentum in 2024 and 2025. The European Union's Markets in Crypto-Assets (MiCA) regulation, which took full effect in 2024, established comprehensive rules for crypto asset service providers, stablecoin issuers, and trading platforms. While MiCA takes a different approach than the CLARITY Act—focusing on service provider regulation rather than asset classification—both frameworks share the goal of providing legal certainty while protecting consumers and maintaining financial stability.

The GENIUS Act, which became law in the United States in 2025, addresses stablecoin regulation through a framework that requires issuers to maintain reserves and comply with banking-style regulations. Together with the CLARITY Act, these legislative efforts create a comprehensive regulatory structure for digital assets that addresses different segments of the crypto ecosystem. The GENIUS Act handles payment tokens, the CLARITY Act addresses the securities-versus-commodities question, and ongoing efforts target areas like decentralized finance (DeFi) and non-fungible tokens (NFTs).

International coordination on crypto regulation remains imperfect, creating opportunities for regulatory arbitrage. Jurisdictions like Singapore, Switzerland, and the United Arab Emirates have established crypto-friendly regulatory frameworks that attract projects seeking alternatives to U.S. and EU oversight. The CLARITY Act's stringent mature blockchain standard may push some projects toward these jurisdictions, particularly if they cannot or will not restructure governance to achieve mature status.

However, the gravitational pull of U.S. capital markets and institutional investors limits the viability of regulatory arbitrage strategies. Projects that exclude U.S. participants to avoid securities regulation sacrifice access to the world's deepest capital markets and most sophisticated institutional investors. The CLARITY Act's passage would likely force many projects to choose between genuine decentralization and permanent exclusion from U.S. markets—a choice that favors regulatory compliance over offshore operations.

Implementation Challenges and Ongoing Uncertainties

Despite the CLARITY Act's passage in the House of Representatives, significant uncertainties remain about its final form and implementation. The Senate has yet to vote on the legislation, and competing proposals from the Senate Banking Committee and Senate Agriculture Committee suggest that negotiations could substantially revise the bill's provisions. The Senate Banking Committee's Responsible Financial Innovation Act (RFIA) introduces broader definitions of digital commodities and emphasizes different regulatory priorities, creating potential conflicts with the House version.

The mature blockchain standard itself may evolve through the legislative process. Some senators have expressed concerns that the current definition sets too high a bar for decentralization, potentially classifying too many digital assets as securities and driving innovation offshore. Others argue that the standard should be even more stringent, ensuring that only truly decentralized networks receive commodity treatment. These debates will shape the final legislation and determine which projects ultimately achieve mature status.

Implementation also raises practical questions about how regulators will assess blockchain maturity. The CLARITY Act envisions a certification process with the SEC, but details about this process remain unclear. Will projects need to proactively seek mature status certification, or will regulators make determinations based on their own analysis? How will borderline cases be resolved, particularly for networks with mixed governance structures or evolving decentralization? What role will technical analysis play versus legal interpretation of control relationships?

The dynamic nature of blockchain governance adds another layer of complexity. Networks that do not currently qualify as mature may achieve that status through governance reforms, while mature networks could theoretically lose their classification if centralized control emerges. This creates ongoing uncertainty and the need for continuous regulatory monitoring, potentially imposing compliance burdens even on mature blockchains.

Looking Ahead: The Future of Blockchain Regulation

The CLARITY Act represents a watershed moment in cryptocurrency regulation, moving from an enforcement-based approach focused on punishing violations to a framework-based approach that provides clear rules for compliance. This shift reflects the maturation of both the crypto industry and regulatory thinking about digital assets. Rather than treating all cryptocurrencies as presumptively problematic, the Act acknowledges that truly decentralized networks serve legitimate purposes and deserve regulatory treatment appropriate to their structure.

For blockchain projects, the message is clear: decentralization is no longer just a philosophical ideal or technical goal but a regulatory requirement for favorable treatment. Projects that successfully achieve genuine decentralization will enjoy significant competitive advantages, while those that maintain centralized control will face increased regulatory scrutiny and compliance costs. This creates powerful incentives for governance innovation and could accelerate the transition toward truly decentralized blockchain ecosystems.

The broader implications extend beyond individual projects to the fundamental nature of blockchain technology. The CLARITY Act's mature blockchain standard enshrines decentralization as the defining characteristic that distinguishes blockchain networks from traditional centralized systems. This regulatory recognition validates the core premise of blockchain technology—that decentralized networks can provide valuable services without centralized control—while acknowledging that not all systems claiming to be blockchains actually achieve meaningful decentralization.

As the legislative process continues and implementation details emerge, the crypto industry faces a period of significant transformation. Projects will need to make strategic decisions about governance structures, token distribution, and regulatory compliance. Investors will need to assess which networks are likely to achieve mature status and how classification affects long-term value. Regulators will need to develop expertise in evaluating blockchain governance and technical architecture to make informed maturity determinations.

The CLARITY Act's mature blockchain test may ultimately prove to be one of the most consequential developments in cryptocurrency regulation, creating a framework that shapes the industry for years to come. For Solana, Cardano, Polkadot, and other major networks that do not currently qualify as mature, the path forward requires difficult choices about governance, control, and regulatory strategy. The decisions these projects make in response to the CLARITY Act will determine not only their own futures but the broader trajectory of blockchain technology and its role in the global financial system.

This article is for informational purposes only and does not constitute legal or investment advice. The CLARITY Act remains pending in the Senate, and its final provisions may differ from the House-passed version. Readers should consult legal and financial professionals before making decisions based on anticipated regulatory changes.

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.

Related Articles