Fed 'Skinny' Accounts & Digital Asset Regulatory Roundup

Welcome to the final regulatory roundup of 2025. This week, the focus is on critical infrastructure and enforcement actions defining operational risk in the digital asset sector. The most impactful development is the Federal Reserve moving forward with 'skinny' accounts, potentially dismantling systemic de-banking concerns. Compliance officers must also prepare for persistent risks like sanctions compliance and developer liability in 2026.

Open Compliance Project: Weekly Regulatory Roundup – December 27, 2025

Welcome to the final regulatory roundup of 2025. This week, the focus shifted from legislative battles to critical infrastructure and enforcement actions that define operational risk in the digital asset sector.

The most impactful development centers on banking access. Reports indicate that the Federal Reserve is moving forward with 'skinny' accounts, potentially dismantling systemic de-banking concerns that have plagued the industry for years. This shift has massive implications for operational stability and growth.

For compliance officers, this period also highlights persistent risks: insider threats, sanctions compliance, and the ongoing debate over developer liability. Navigating 2026 will require proactive risk management alongside adapting to evolving infrastructure access.

Infrastructure and Access: The De-Banking Dilemma

The ability for digital asset firms to access basic banking services remains a foundational compliance and operational hurdle. Recent developments suggest a potential easing of these pressures, though friction points persist, particularly regarding sanctions screening.

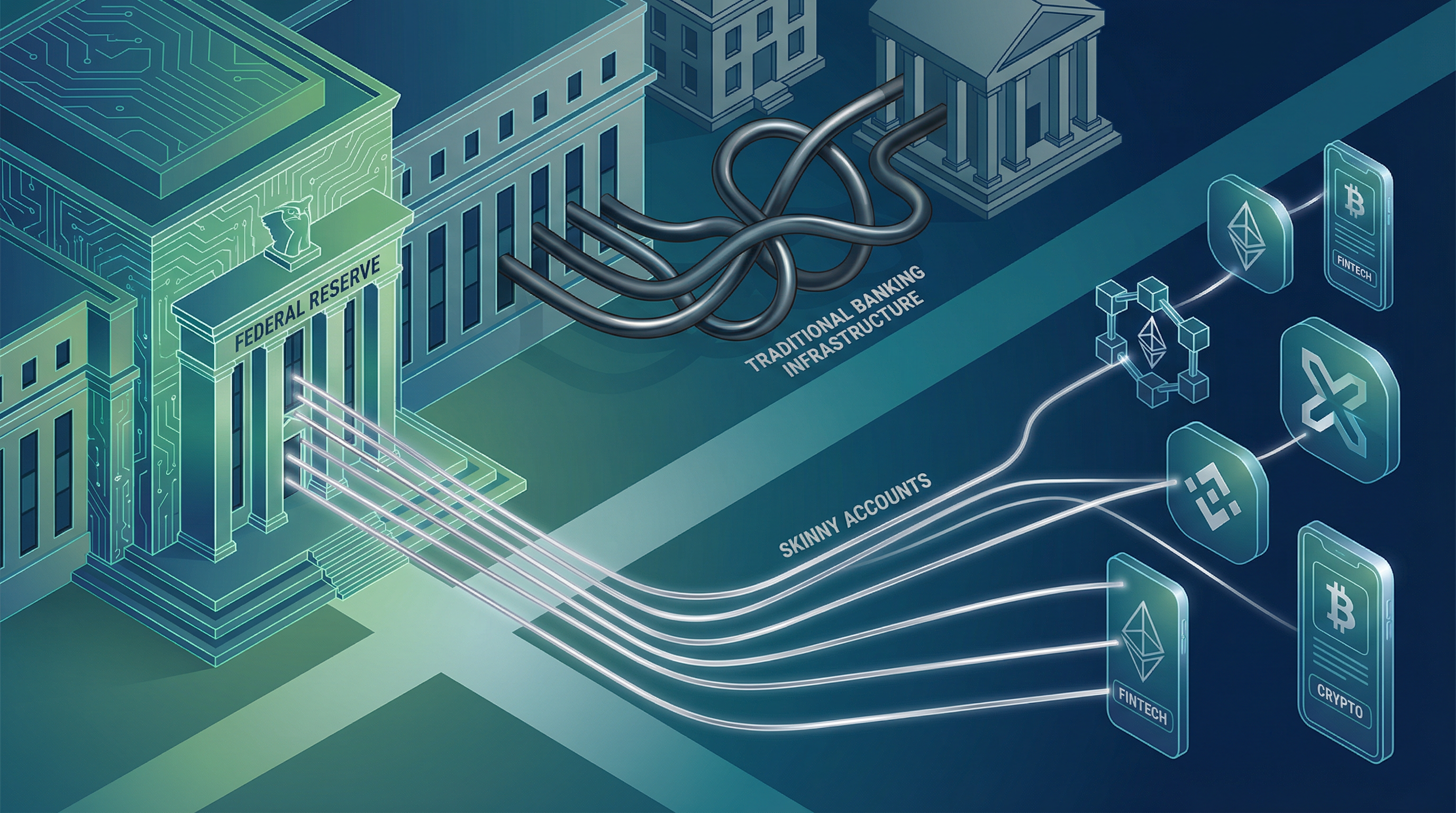

Federal Reserve Accounts and Operational Stability

Senator Cynthia Lummis stated that the Federal Reserve’s move toward offering 'skinny' accounts could effectively end what some critics term "Operation Chokepoint 2.0".

These accounts grant crypto companies and fintech startups direct access to the Federal Reserve system. This access hedges against commercial banks unilaterally denying services, a practice known as de-banking.

For businesses, this represents a significant increase in operational stability. Relying solely on a few commercial banks creates single points of failure, which is a major compliance risk, especially for maintaining liquidity and payroll.

While direct access is a positive step toward infrastructure neutrality, it does not eliminate regulatory oversight. Firms utilizing these accounts will still face rigorous scrutiny regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols.

Persistent Sanctions Friction

Despite potential Federal Reserve access, commercial bank reluctance remains high, particularly concerning sanctions compliance. This was highlighted by a recent report involving JPMorgan Chase.

JPMorgan reportedly froze accounts belonging to two stablecoin startups, BlindPay and Kontigo. The reason cited was exposure to sanctioned jurisdictions.

This action underscores the intense focus banks place on sanctions screening, particularly when dealing with companies involved in decentralized finance or stablecoins, where transaction visibility can be complex.

For stablecoin issuers and firms handling cross-border payments, this serves as a critical reminder: traditional financial institutions (TradFi) apply a zero-tolerance policy for perceived sanctions risk. Proactive compliance screening, even for indirect exposure, is essential to maintaining banking relationships.

The GENIUS Act Debate and Competition

The CEO of Coinbase, Brian Armstrong, warned that reopening the GENIUS Act is a "red line" and criticized bank lobbying efforts. This relates directly to the competitive landscape surrounding stablecoins.

The GENIUS Act aims to provide a clear regulatory framework for stablecoins. Armstrong accuses banks of lobbying Congress to block stablecoin rewards and limit competition in the payments sector.

This political friction highlights a core challenge in regulatory development: incumbent financial institutions often seek rules that protect their market share. Clear, fair regulation should focus on risk mitigation and consumer protection, not restricting innovation or competition.

Compliance teams should monitor the GENIUS Act closely. Its final form will dictate requirements for reserves, redemption mechanisms, and potentially, the ability to offer yield or rewards on stablecoin holdings.

Enforcement, Security, and Insider Threats

While infrastructure access improves, enforcement actions and security failures continue to define operational risk. Recent events emphasize the necessity of robust internal controls and immediate response planning.

Insider Threat Enforcement

The industry saw a significant enforcement action regarding insider trading, demonstrating global cooperation in addressing internal threats.

Coinbase CEO Brian Armstrong announced the first arrest in India related to an insider data breach. He stated that "more still to come" regarding this investigation.

This arrest confirms that insider trading within digital asset platforms is a priority for global law enforcement and regulators. It reinforces the need for strict internal data access controls, monitoring, and clear policies regarding employee trading.

For compliance programs, the focus must be on preventing data leakage and misuse. This includes strong segregation of duties, comprehensive surveillance of employee activity, and mandatory ethics training focused on market manipulation and data security.

Wallet Security and Compensation

Security failures, even those external to centralized exchanges, carry significant compliance and reputational risk. Trust Wallet recently addressed a major security incident.

Trust Wallet launched a compensation process for victims of a $7 million browser extension hack. This move aims to restore user confidence following the exploit.

While compensation is not legally required in all jurisdictions, offering remediation is often viewed as a necessary step for maintaining consumer trust and demonstrating corporate responsibility.

Businesses handling customer assets must treat security failures as compliance events. This requires clear communication, immediate forensic investigation, and establishing a transparent process for compensating users where negligence or system failure is proven.

Developer Liability and Privacy Tools

The ongoing legal battles concerning developers of privacy-enhancing tools continue to raise complex questions about liability in decentralized systems.

Samourai Wallet co-founder spent Christmas Eve recounting his first day in prison, reigniting debate over developer liability and executive clemency.

The core issue here is whether developing neutral, privacy-focused software constitutes aiding and abetting illicit activity. Regulators are attempting to draw a line between offering a tool and participating in its misuse.

For firms involved in decentralized protocol development, this situation creates significant legal uncertainty. Compliance strategy must now involve careful legal review of code functionality and ensuring that tools, while private, do not actively circumvent established AML/KYC requirements.

Global Regulatory Trajectories and Market Maturation

Looking ahead to 2026, the regulatory environment is characterized by increasing institutional adoption and clearer jurisdictional boundaries, particularly in Asia and the US.

Institutional Clarity and SEC Filings

The increasing regulatory clarity, particularly around Bitcoin products, is driving institutional engagement.

Bitcoin is driving a record spike in SEC filings in 2025. This indicates that regulatory clarity is pulling institutions toward on-chain activities.

When regulatory frameworks become clearer—even if they are restrictive—it reduces uncertainty, which is the primary barrier for large financial institutions. This spike in filings suggests that the path for compliant institutional participation is becoming well-defined.

This institutionalization means compliance standards will rise across the board. Service providers must adopt the rigor expected by traditional finance, including advanced audit capabilities, robust custody solutions, and detailed reporting mechanisms.

US Regulatory Power Dynamics

The US regulatory landscape for 2026 suggests a continuing power struggle between key agencies, with the CFTC potentially gaining influence.

Projections indicate that the SEC’s ambitious agenda will meet a more empowered CFTC in 2026. This shift relates to the ongoing debate over whether certain digital assets are securities or commodities.

If the CFTC gains jurisdiction over more assets classified as commodities, it could lead to different compliance requirements than those currently imposed by the SEC. Commodity regulation typically focuses more on market integrity and derivatives trading.

Businesses need to prepare for dual-agency oversight. This involves structuring operations to comply with both securities laws (SEC) and commodities laws (CFTC), depending on the nature of the assets and services offered.

Asia’s Focus on Stablecoins and RWA

Regulatory developments in Asia are clearly prioritizing two key areas: stablecoins and Real-World Asset (RWA) tokenization.

Stablecoins and RWA tokenization are shaping Asia’s crypto rulebook in 2025. This focus reflects practical application and financial stability concerns.

Asian regulators are often pragmatic, focusing on the immediate financial stability risks posed by stablecoins and the efficiency gains offered by tokenizing traditional assets. This provides a clearer path for compliant innovation in these specific areas.

Firms targeting Asian markets should align their compliance programs with emerging frameworks that mandate reserve transparency, auditability, and clear legal status for tokenized assets. This regional focus provides a template for global adoption in these specific use cases.

Key Takeaways

- Diversify Banking Relationships: Actively pursue access to Federal Reserve 'skinny' accounts as they become available to mitigate reliance on commercial banks and reduce single-point-of-failure risk.

- Enhance Sanctions Screening: Implement real-time, comprehensive sanctions screening tools that cover indirect exposure, especially if dealing with stablecoins or cross-border payments, to protect existing banking relationships.

- Strengthen Insider Controls: Immediately review and reinforce internal data access policies, employee trading restrictions, and surveillance systems to prevent insider data breaches and manipulation.

- Monitor GENIUS Act Progress: Track the legislative movement of the GENIUS Act to anticipate future requirements regarding stablecoin reserves, redemption, and potential limitations on reward mechanisms.

- Prepare for Dual Oversight: Structure compliance programs to meet the requirements of both the SEC (securities) and the potentially expanded jurisdiction of the CFTC (commodities) in 2026.

- Formalize Security Response: Develop a formal, transparent compensation and communication plan for security incidents, treating major hacks as critical compliance and reputational events.

- Review Developer Liability Risk: If developing decentralized tools, conduct thorough legal reviews to ensure the software design does not actively facilitate regulatory circumvention, given the current enforcement climate against developers.

What's Next

As we enter 2026, the regulatory focus will shift from foundational debates to detailed implementation. The key trend is the maturation of infrastructure access alongside the intensification of enforcement against bad actors, both internal and external.

Businesses must leverage the potential stability offered by direct Fed access while simultaneously tightening internal controls to meet the rising standards expected by institutional participants. The convergence of TradFi and digital asset compliance standards is now inevitable.

The next few months will reveal the specific rules accompanying new banking access and the final jurisdictional boundaries between the SEC and CFTC. Prepare by conducting a gap analysis now, ensuring your AML, KYC, and security protocols meet institutional-grade requirements. Proactive compliance is the only viable strategy moving forward.

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.

Related Articles