GENIUS Act: Complete Guide to US Stablecoin Regulation

President Trump signed the GENIUS Act into law in July 2025, creating the first federal regulatory framework for stablecoins in the United States. Learn how this landmark legislation affects crypto businesses, consumers, and the global digital asset landscape.

On July 18, 2025, President Donald J. Trump signed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act into law, marking a watershed moment for cryptocurrency regulation in the United States.

This landmark legislation establishes the first comprehensive federal regulatory framework for payment stablecoins, addressing years of regulatory uncertainty that has hindered institutional adoption and innovation in the digital asset sector.

For crypto businesses, financial institutions, and stablecoin issuers, understanding the GENIUS Act's requirements is now essential for compliance and strategic planning.

What the GENIUS Act Regulates

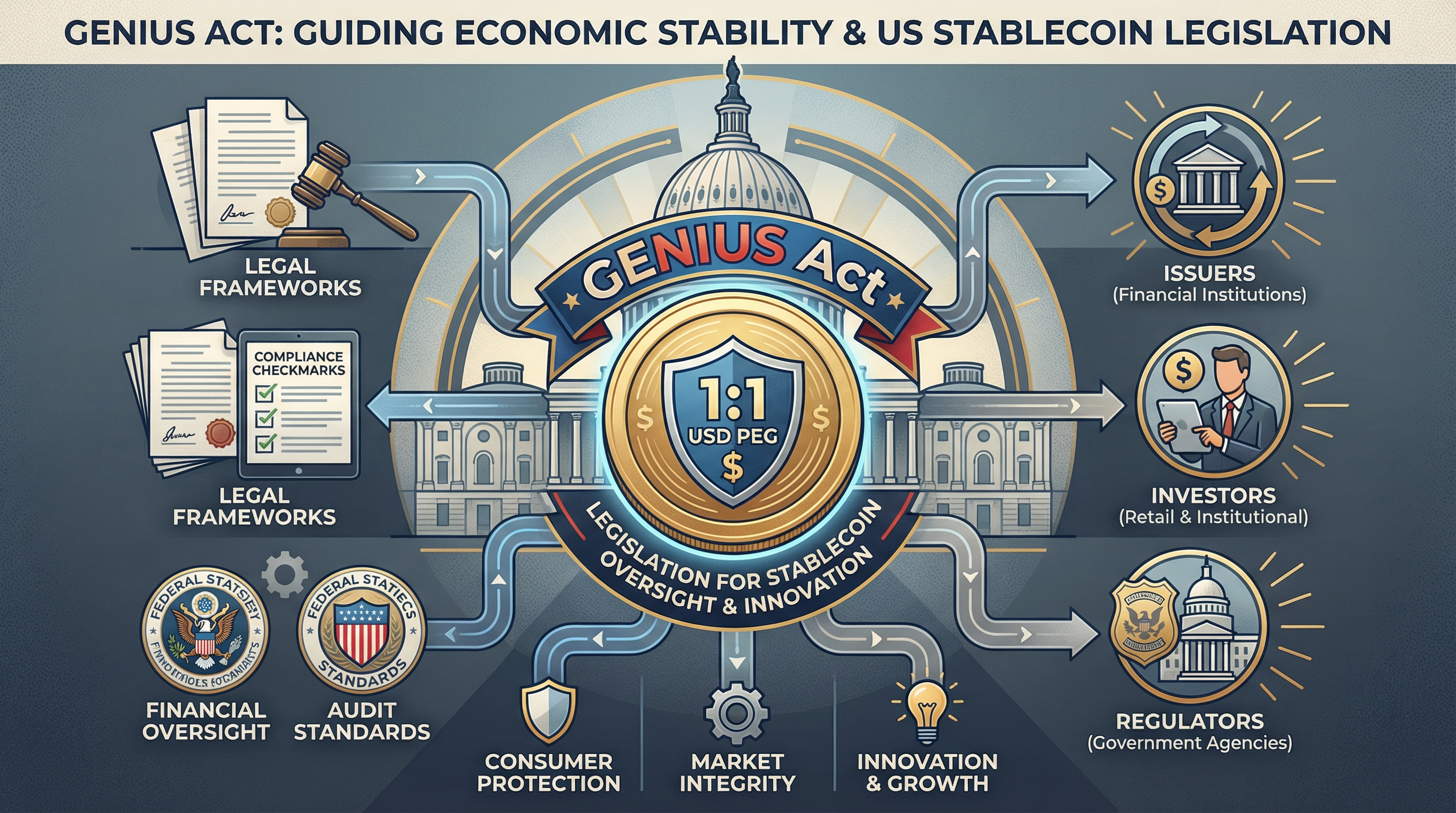

The GENIUS Act specifically targets "payment stablecoins"—digital assets that issuers must redeem for a fixed value, typically pegged to the U.S. dollar. This includes popular stablecoins like USDC, USDT, and similar dollar-backed digital currencies used for payments and settlements.

The legislation creates a clear distinction between payment stablecoins and other digital assets. Bitcoin, Ethereum, and other cryptocurrencies without fixed redemption values fall outside this regulatory framework and remain subject to existing securities and commodities regulations.

This focused approach provides regulatory clarity for the stablecoin market while avoiding the complexity of regulating the entire digital asset ecosystem under a single framework.

Reserve Requirements and Consumer Protection

The cornerstone of the GENIUS Act is its stringent reserve requirement designed to ensure stablecoin stability and protect holders from issuer insolvency.

100% Reserve Backing

All payment stablecoin issuers must maintain 100% reserve backing with highly liquid assets. Acceptable reserve assets include U.S. dollars held in insured depository institutions and short-term U.S. Treasury securities.

This requirement eliminates the risk of fractional reserve practices that could leave stablecoin holders unable to redeem their holdings during periods of stress. The liquid nature of required reserves ensures issuers can meet redemption requests promptly.

Monthly Public Disclosures

Issuers must make monthly public disclosures detailing the composition of their reserves. This transparency requirement allows holders, regulators, and market participants to verify that reserves match outstanding stablecoin supply.

These disclosures must be accessible to the public, creating accountability and enabling independent verification of issuer claims. For compliance teams, establishing systems to produce accurate monthly attestations will be a critical operational requirement.

Insolvency Protections

In the event of issuer insolvency, the GENIUS Act prioritizes stablecoin holders' claims over all other creditors. This provision creates a final backstop of consumer protection, ensuring holders can recover their funds even if the issuer faces financial distress.

This priority claim structure is significant because it treats stablecoin holders more favorably than typical unsecured creditors, recognizing the payment function these instruments serve.

Marketing and Disclosure Rules

The GENIUS Act imposes strict marketing rules to prevent consumer confusion and deceptive practices.

Stablecoin issuers are explicitly forbidden from making misleading claims that their stablecoins are backed by the U.S. government, federally insured, or constitute legal tender. These prohibitions address a longstanding concern that consumers might misunderstand the nature of stablecoin backing and assume government guarantees that do not exist.

Issuers must clearly communicate the risks associated with stablecoin holdings, including the fact that stablecoins are not FDIC-insured deposits and do not carry the full faith and credit of the United States government.

For marketing and communications teams at stablecoin issuers, reviewing all customer-facing materials for compliance with these rules is an immediate priority.

Who Can Issue Stablecoins

The GENIUS Act establishes a permissioned framework for stablecoin issuance. Only "permitted payment stablecoin issuers" may legally issue stablecoins in the United States.

Eligible Issuer Types

Permitted issuers fall into three categories:

Insured Depository Institutions: Banks and credit unions that hold FDIC or NCUA insurance can issue stablecoins directly, subject to approval from their primary federal regulator.

Nonbank Federal Issuers: Nonbank entities can obtain federal approval to issue stablecoins through a registration process with federal banking regulators. This pathway allows fintech companies and specialized stablecoin issuers to operate under federal oversight.

State-Qualified Nonbank Issuers: States can establish their own licensing frameworks for stablecoin issuers, provided these frameworks meet minimum federal standards. State-licensed issuers must still comply with federal requirements, but states retain flexibility in their supervisory approach.

Bank Subsidiaries

The GENIUS Act allows insured depository institutions to issue payment stablecoins through subsidiaries. This structure enables banks to enter the stablecoin market while maintaining separation between traditional banking operations and digital asset activities.

In December 2025, the FDIC issued a proposed rule establishing application procedures for banks seeking to issue stablecoins through subsidiaries. This proposal outlines capital requirements, risk management expectations, and operational standards that bank-issued stablecoins must meet.

For banks considering stablecoin issuance, the subsidiary structure offers a pathway to participate in this growing market while managing regulatory and operational risks.

Federal and State Coordination

One of the GENIUS Act's key achievements is aligning federal and state stablecoin frameworks to create consistent regulation across jurisdictions.

States retain authority to license and supervise stablecoin issuers, but state frameworks must meet federal minimum standards. This approach balances federalism with the need for uniform consumer protection and systemic risk management.

For multi-state stablecoin issuers, this coordination reduces compliance complexity compared to navigating entirely separate state regimes. However, issuers must still monitor state-level requirements and ensure their operations comply with both federal and applicable state rules.

Anti-Money Laundering and Sanctions Compliance

The GENIUS Act explicitly subjects stablecoin issuers to the Bank Secrecy Act, bringing them firmly within the existing AML/CFT regulatory framework.

BSA Obligations

Stablecoin issuers must establish comprehensive anti-money laundering and sanctions compliance programs. These programs must include:

- Risk assessments identifying money laundering and terrorist financing vulnerabilities

- Customer identification and verification procedures (Know Your Customer requirements)

- Ongoing transaction monitoring to detect suspicious activity

- Suspicious Activity Report (SAR) filing when required

- Sanctions list screening against OFAC and other designated lists

These requirements are not new concepts for financial institutions, but they represent a significant compliance burden for technology companies entering the stablecoin market without prior experience in financial services regulation.

Technical Compliance Capabilities

The GENIUS Act imposes a critical and unprecedented requirement on all stablecoin issuers: they must possess the technical capability to freeze, seize, or burn stablecoins when legally required. This requirement applies universally—to domestic and foreign issuers, banks and nonbanks, centralized and decentralized protocols.

This mandate represents a fundamental design constraint that affects smart contract architecture, operational procedures, and the philosophical approach to stablecoin issuance.

Freeze, Seize, and Burn: What Each Means

Freezing refers to the ability to prevent a specific address or wallet from transferring stablecoins. The tokens remain in the wallet and visible on the blockchain, but they cannot be moved. This capability is typically used when law enforcement suspects illicit activity but investigation is ongoing.

Seizing means transferring stablecoins from a target address to a designated law enforcement or regulatory wallet. This is the digital equivalent of asset forfeiture and requires the issuer to execute an on-chain transaction moving tokens without the private key holder's consent.

Burning involves permanently destroying stablecoins, removing them from circulation entirely. This might be required when tokens are determined to be proceeds of crime and cannot be returned to legitimate owners, or when court orders mandate destruction rather than transfer.

Smart Contract Implementation Requirements

For most stablecoin implementations, these capabilities must be built into the token's smart contract from deployment. The contract must include administrative functions that allow authorized parties (typically the issuer's compliance team or designated wallet) to execute freeze, seize, and burn operations.

Freezing mechanisms typically involve maintaining a blacklist or blocklist within the smart contract. When an address is added to this list, the contract's transfer function checks the list before executing any transaction. If either the sender or recipient is blacklisted, the transaction reverts.

This requires careful smart contract design to ensure the blacklist check does not create excessive gas costs or introduce vulnerabilities. The blacklist management functions themselves must be secured with multi-signature controls or similar governance mechanisms to prevent unauthorized use.

Seizing mechanisms require an administrative transfer function that bypasses normal access controls. This function must be restricted to authorized addresses and should emit clear on-chain events for transparency and auditability.

The challenge here is balancing security (preventing unauthorized seizures) with operational flexibility (allowing legitimate law enforcement actions). Many issuers implement time-locked multi-signature schemes where multiple parties must approve a seizure, with a delay period allowing for emergency intervention if the action is unauthorized.

Burning mechanisms are conceptually simpler—the contract must allow authorized parties to reduce the total supply by destroying tokens in a specific address. However, the accounting implications are significant. Issuers must ensure that burned tokens are matched by corresponding reductions in reserve assets, maintaining the 1:1 backing ratio.

Operational Procedures and Governance

Beyond smart contract capabilities, issuers must establish operational procedures for receiving, verifying, and executing lawful orders to freeze, seize, or burn tokens.

Lawful order verification is critical. Issuers must have processes to authenticate that requests come from legitimate law enforcement or regulatory authorities with proper jurisdiction. This typically involves designated points of contact, secure communication channels, and legal review before execution.

The GENIUS Act requires compliance with "lawful orders," which generally means court orders, subpoenas, or directives from agencies with statutory authority. Issuers should not execute freezes or seizures based on informal requests or foreign government demands without proper legal process.

Response timeframes matter operationally. Law enforcement may require immediate action to prevent dissipation of assets. Issuers should establish 24/7 on-call procedures for compliance teams to respond to urgent requests, while maintaining appropriate verification safeguards.

Record-keeping and reporting obligations accompany these capabilities. Issuers must maintain detailed logs of all freeze, seize, and burn actions, including the legal basis, requesting authority, and execution details. These records will be subject to regulatory examination and may be required in legal proceedings.

Challenges for Decentralized Protocols

For stablecoin protocols that aspire to decentralization, these requirements present significant design tensions. True decentralization implies no central party can unilaterally control token transfers, yet the GENIUS Act mandates exactly such control.

Most "decentralized" stablecoins operating under the GENIUS Act will need to adopt hybrid models. The protocol may be decentralized in governance or reserve management, but the token contract itself must retain centralized administrative functions for compliance.

This has led to philosophical debates within the crypto community about whether GENIUS Act-compliant stablecoins can legitimately be called decentralized. From a regulatory perspective, the answer is clear: compliance with lawful orders is non-negotiable, regardless of protocol design philosophy.

Some protocols are exploring technical approaches like multi-jurisdictional governance, where freeze/seize actions require approval from multiple independent parties across different legal systems. However, these approaches must still ultimately comply with U.S. law for tokens offered to U.S. persons.

Foreign Issuer Compliance and Enforcement

The GENIUS Act's reach extends to foreign stablecoin issuers serving U.S. customers. Foreign issuers must implement the same technical capabilities and comply with U.S. lawful orders, even if their primary operations and user base are outside the United States.

The enforcement mechanism for foreign issuer non-compliance is significant. The Treasury Department has authority to designate foreign stablecoin issuers as "noncompliant" if they fail to comply with lawful orders or lack the required technical capabilities.

Once designated as noncompliant, U.S.-based centralized digital asset service providers—including exchanges, payment processors, and custodians—are prohibited from facilitating secondary trading of that foreign stablecoin. This effectively cuts off the U.S. market for non-compliant foreign issuers.

This extraterritorial application of U.S. law is controversial but reflects the dollar's central role in global stablecoin markets. Foreign issuers must weigh the compliance costs against the value of U.S. market access.

Annual Certification Requirements

Beyond implementing the capabilities, issuers must annually certify compliance with the GENIUS Act's AML provisions, including the technical capability requirements. This certification is a higher reporting obligation than what traditional banks face.

The annual certification must be signed by senior executives and submitted to the issuer's primary regulator. False certification can result in civil and criminal penalties, creating personal liability for executives who attest to capabilities that do not exist or do not function as required.

Issuers should conduct internal testing of freeze, seize, and burn functions at least annually, documenting the results to support their certification. Many will likely engage third-party auditors to verify these capabilities independently.

Integration with Transaction Monitoring

The technical compliance capabilities must integrate with the issuer's broader AML and sanctions compliance program. Transaction monitoring systems should flag suspicious activity and automatically generate alerts for potential freeze actions.

When sanctions lists are updated—such as when OFAC designates new individuals or entities—issuers must quickly check whether any existing token holders match the new designations. If matches are found, immediate freeze actions may be required.

This requires real-time or near-real-time integration between sanctions screening systems and the smart contract's administrative functions. The operational complexity of maintaining this integration should not be underestimated.

Smart Contract Upgradeability Considerations

Some issuers may consider using upgradeable smart contract patterns to add or modify compliance capabilities over time. While this provides flexibility, it also introduces security risks and governance challenges.

Regulators will likely scrutinize upgrade mechanisms to ensure they cannot be used to circumvent compliance requirements or harm token holders. Any upgrade capability must be subject to strong governance controls, typically involving time locks and multi-party approval.

Issuers should document their upgrade procedures and ensure they align with regulatory expectations. Surprise upgrades that materially change token functionality without notice could violate consumer protection rules.

Practical Implementation Checklist

For stablecoin issuers implementing technical compliance capabilities, the following checklist covers essential requirements:

Smart Contract Functions:

- Blacklist/blocklist mechanism to prevent transfers from or to designated addresses

- Administrative transfer function to seize tokens from any address

- Burn function to destroy tokens in designated addresses

- Multi-signature or governance controls on all administrative functions

- Event emission for all compliance actions for transparency and auditability

Operational Procedures:

- Designated legal and compliance contacts for receiving lawful orders

- Verification procedures to authenticate law enforcement requests

- 24/7 on-call procedures for urgent compliance actions

- Legal review process before executing freeze, seize, or burn actions

- Comprehensive record-keeping system for all compliance actions

Technical Infrastructure:

- Secure key management for administrative wallet(s)

- Integration between sanctions screening systems and smart contract controls

- Automated monitoring for newly designated sanctioned entities

- Testing and audit procedures for compliance functions

- Disaster recovery procedures for compliance systems

Governance and Oversight:

- Board or executive-level oversight of compliance capability use

- Internal audit of compliance actions and procedures

- Annual third-party verification of technical capabilities

- Executive certification process for annual regulatory filings

- Training programs for staff authorized to execute compliance actions

The Compliance-Innovation Balance

The technical compliance requirements represent a significant departure from the permissionless, censorship-resistant ethos that originally motivated cryptocurrency development. However, they reflect a pragmatic reality: stablecoins function as payment instruments within the regulated financial system and must be subject to law enforcement and regulatory oversight.

For issuers, the challenge is implementing these requirements efficiently while maintaining the speed, cost advantages, and global reach that make stablecoins attractive compared to traditional payment rails.

The most successful issuers will be those who treat compliance capabilities not as burdensome add-ons, but as core features that enable institutional adoption and regulatory approval. Clear documentation, robust testing, and transparent operation of these capabilities will build trust with regulators, law enforcement, and legitimate users.

Impact on the U.S. Dollar and Treasury Market

Beyond consumer protection and AML compliance, the GENIUS Act serves broader economic policy objectives related to the U.S. dollar's global reserve currency status.

Increased Treasury Demand

By requiring stablecoin issuers to back their assets with U.S. Treasuries and dollars, the GENIUS Act creates structural demand for U.S. government debt. As the stablecoin market grows, this demand could provide meaningful support for Treasury markets.

For context, the combined market capitalization of major dollar-pegged stablecoins exceeded $150 billion in 2025. If this market continues to expand, the Treasury holdings required to back these stablecoins could represent a significant and stable source of demand.

Dollar Dominance

Stablecoins extend the reach of the U.S. dollar into digital commerce and cross-border payments. By establishing a clear regulatory framework that encourages compliant stablecoin growth, the GENIUS Act positions the dollar to maintain its dominance in the emerging digital economy.

This strategic consideration was a key driver of the legislation's bipartisan support, as policymakers recognized the risk that unregulated or foreign-issued stablecoins could erode dollar usage in digital transactions.

Implementation Timeline and Next Steps

While the GENIUS Act became law in July 2025, full implementation requires additional rulemaking by federal and state regulators.

Federal Rulemaking

The FDIC, OCC, Federal Reserve, and NCUA are developing detailed rules for stablecoin issuer applications, capital requirements, and ongoing supervision. The FDIC's December 2025 proposal for bank subsidiary issuance represents the first major implementation step.

Treasury Department agencies, including FinCEN, are clarifying BSA compliance expectations specific to stablecoin issuers. These agencies are expected to issue guidance on transaction monitoring, SAR filing thresholds, and sanctions screening procedures tailored to stablecoin operations.

State Frameworks

States are developing or updating their money transmitter and financial services licensing frameworks to accommodate stablecoin issuers. Several states, including New York, Wyoming, and Texas, have already begun this process.

Issuers planning to operate in multiple states should monitor these state-level developments and engage with state regulators early in their planning process.

Compliance Deadlines

Existing stablecoin issuers have a transition period to come into compliance with the GENIUS Act's requirements. The specific deadlines vary depending on issuer type and the particular requirement, but most provisions take full effect by mid-2026.

New issuers must obtain appropriate federal or state approval before launching operations. This approval process can take several months, so companies planning to enter the stablecoin market should begin their applications well in advance of their intended launch date.

Key Takeaways for Businesses

- Obtain proper authorization: Stablecoin issuance now requires federal or state approval. Begin the application process early and budget for compliance costs.

- Implement robust reserve management: Establish systems to maintain 100% liquid reserves and produce monthly public attestations. Consider third-party auditors to verify reserve adequacy.

- Build comprehensive AML/CFT programs: If you lack financial services compliance experience, consider hiring experienced BSA officers or engaging compliance consultants.

- Develop technical compliance capabilities: Ensure your smart contracts and systems can freeze, seize, or burn tokens when legally required. Test these capabilities thoroughly.

- Review all marketing materials: Remove any claims that could mislead consumers about government backing, insurance, or legal tender status. Clearly disclose risks.

- Monitor state-level developments: If operating in multiple states, track state licensing requirements and ensure compliance with both federal and state rules.

- Plan for ongoing supervision: Federal and state regulators will conduct regular examinations of stablecoin issuers. Establish internal audit and compliance monitoring systems to prepare for this oversight.

What's Next for Stablecoin Regulation

The GENIUS Act represents a major step forward in digital asset regulation, but it is not the final word on stablecoins or crypto policy more broadly.

Regulators are still developing detailed rules for implementation, and these rules will shape the practical compliance burden and operational requirements for issuers. Industry participants should engage in the rulemaking process through comment letters and stakeholder meetings to ensure regulations are workable and effective.

Congress is also considering additional digital asset legislation addressing topics the GENIUS Act does not cover, including market structure for crypto exchanges, custody standards, and taxation. The success of the GENIUS Act's implementation may influence the approach taken in these other policy areas.

For businesses in the stablecoin market, the GENIUS Act creates both challenges and opportunities. Compliance costs will increase, but regulatory clarity should attract institutional capital and enable broader adoption. Companies that invest in robust compliance infrastructure now will be well-positioned to compete in the regulated stablecoin market of the future.

Stay Updated

Get weekly regulatory updates and compliance insights delivered to your inbox.

No spam. Unsubscribe anytime.

Related Articles